Ukraine Crisis

As the tragedy unfolds, please see below some potential effects this may have on the UK petrochemical industry.

Last Updated: 02/03/2022

Oil & Gas

We are all seeing the immediate effects of the crisis with record prices at petrol and diesel at the pumps. Oil prices are currently in a volatile state, but some analysts expect oil prices to hit $110 / bbl in March. Some have said that prices could hit $135 / bbl this year.

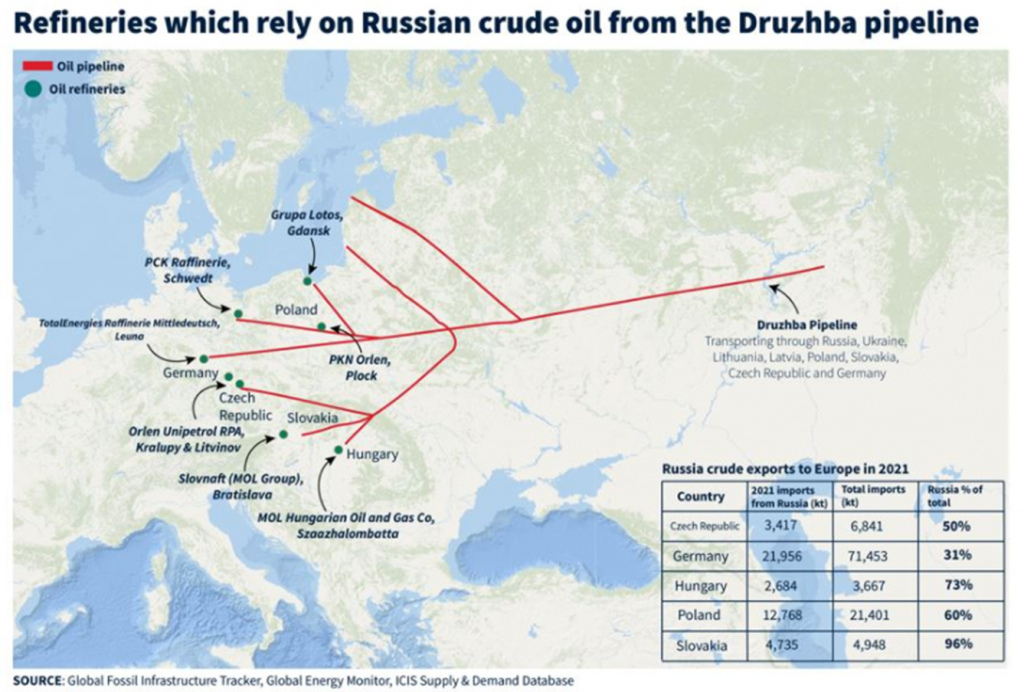

Russia supplies significant amounts of oil and gas to Europe and at any given time, supplies approximately, ¼ of our crude oil needs. This oil comes through the Druzhba pipeline and is shown below with some statistics.

Russia supplies approximately 50% of Europe’s Naphtha requirements. These refineries produce approximately 2.8m MT of Ethylene and 2.34m MT of Propylene monomers (11% and 12% of European capactiy respectively).

As Naphtha flows from Russia are interrupted, stocks of Naphtha imports in the ARA (Antwerp, Rotterdam, Amsterdam) main European hubs are at the lowest level since 2016.

The chairman of BASF has said that supplies of Naphtha can be supplied by alternative routes, but this will take time to arrange and could lead to short term issues in supply.

With Naphtha interrupted and more expensive due to rising oil costs, it’s inevitable that monomers will increase and Propylene C3 has just hit another record at €1,450 / MT, an increase of €95 / MT. Ethylene C2 also increased by €95 / MT to €1,435 / MT.

In addition to the increased raw material costs, energy is at an all-time high, and this will lead to increased production costs.

Whilst major manufacturers of polymers have benefited from significant margins in 2021, they are starting to feel the squeeze as their costs increase and they have started to see selling prices erode as demand lags supply.

All major producers are expected to increase prices for polymers but there is still a lot of uncertainty. A large increase could still see a lot of push back from buyers. Whilst some supply interruption is expected, it’s probably not enough to cause any significant shortages just yet. We can expect to see a wide range of prices and many changes of direction as the situation develops.

Supply & Demand

Recent months have seen normal and slightly muted demand. European production has been able to meet most needs on many grades and imports started to flow again from around the world.

With no supply issues, buyers looked to secure deals and have also restricted buying in the anticipation of decreases in the coming months.

This could have led to low levels of inventories at converters and with a new global crisis to contend with, some will seek to replenish stocks with a higher degree of safety built in. A sudden spike in demand could quickly use up local stocks and with Supply Chains interrupted, replenishment becomes more difficult. In the same way that a small interruption to petrol supplies in the UK led to panic buying and demand spiralling, a smaller scale version of that could take place with polymer supplies.

Logistics

Whilst Europe has local production of PE and PP, we are still dependent on imports, particularly regarding LLDPE and HDPE.

The early part of 2022 saw many offers for lower priced imports from USA, although supplies of these are now low, in part due to local strong demand but also due to significant disruption at the Port of Houston.

The conflict in Ukraine has led to some shipping routes into Europe being affected. Some routes are closed completely, whilst others could see disruption as sanctions are enforced and ships are checked. Supply routes from the Middle East are already extended and shipping from the Far East remains the more expensive option.

We can expect to see challenges around replenishing local stocks on key import grades of material.

Summary

Prices in March are expected to rise. Most suppliers expect to pass through the monomer increases of €95 / MT but the supply / demand picture is unclear and this will be the main driver of pricing.