Crisis in the Red Sea:

What does this mean for polymer supply to the UK?

By Dionne Wardle

Supply Chain Manager

Plastribution Group

Last Updated: 08/01/2024

In recent weeks, increasing attacks on commercial vessels operating in the Red Sea and the Gulf of Aden, have led to most freight ships diverting from the Suez Canal, despite the presence of a coalition naval task force in the area.

This situation is evolving and additional developments are anticipated. The re-routing will result in increased costs, extended mileage and longer transit times.

What is the Suez Canal?

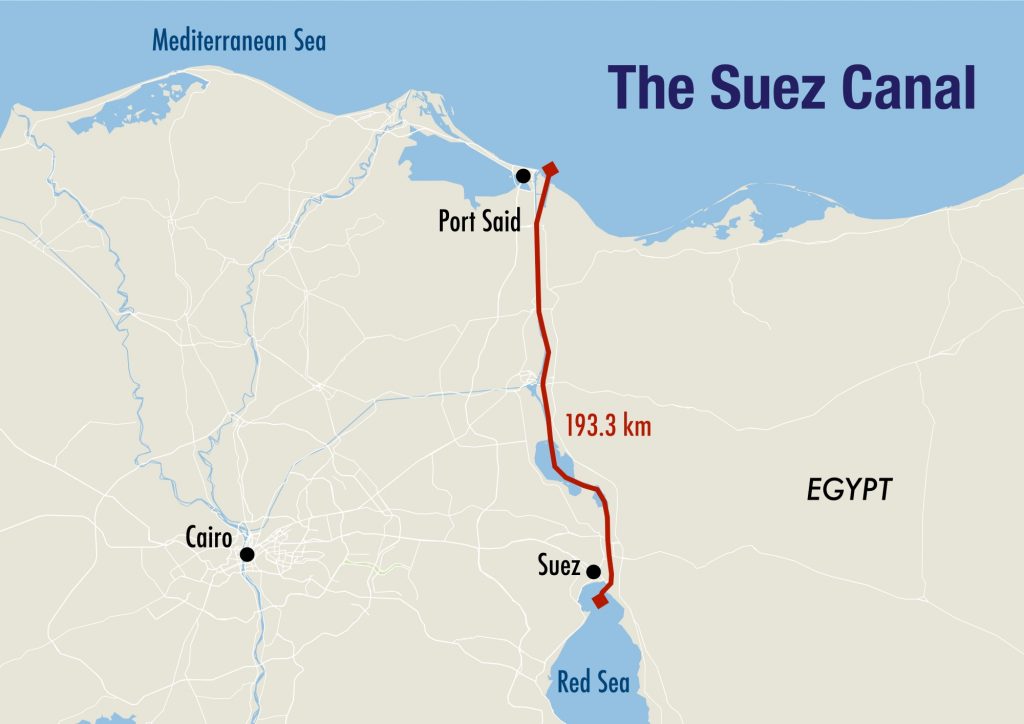

The Suez Canal, a 194km waterway, is the most efficient and quickest maritime route between Asia and Europe. It is strategically important for global trade and accommodates 60% of the world’s tanker fleet, 90% of bulk carriers and all types of containers, car carriers and general cargo ships.

Alternative routes for shipments from Asia into Europe either involve circumnavigating the southern coast of Africa, adding over 11,000 nautical miles to the average journey, or diverting via the Panama Canal, which is currently experiencing congestion.

What has been the supply chain impact so far?

MSC and Maersk, leading global container shipping companies, announced their decision to bypass the Suez Canal due to ongoing attacks. Other major freight companies have suspended Red Sea transits until further notice.

This situation has led to delays and increased costs for importers and exporters, potentially causing temporary shortages of specific products.

What is the likely impact on polymers?

Polymers produced in the Middle East or Asia are most affected, with extended lead times. Polymers from other regions might also face delays due to route congestion.

Logistics costs are rising, but typically these are a relatively minor component of overall polymer costs.

Polymer prices could temporarily spike due to shortages, though global supplies as of January 2024 remain plentiful.

Oil price is an important indicator of polymer prices and often reacts to geopolitical shocks, but so far this has been relatively stable.

How is Plastribution mitigating the impact?

Plastribution hold over 5,000T of stock in the UK at any time to mitigate supply chain disruptions.

We are actively collaborating with our key producer partners to understand and minimise the impact on our UK customers. Our stock modelling systems now account for longer lead times and we are maintaining higher stock levels where feasible.

Plastribution recognises the critical importance of supply chain security for our customers and is dedicated to ensuring consistent supply. Our customer service team can provide detailed advice on specific material-related issues.

Additionally, we offer several services to reduce business risk, such as customer specific stock holding and call-off orders.

For more information on how these supply issues influence prices, please visit Price Know-How – Plastribution Group’s polymer pricing report.

Further Reading:

Here are some links that help qualify the developing situation:-

https://www.bbc.co.uk/news/business-67865064

https://www.lloydslist.com/LL1147705/Houthi-attack-prompts-Maersk-to-slow-Suez-transits

https://www.ft.com/content/87b0a57b-3fd5-4f31-9a7b-da9509077da8

https://www.cnbc.com/2024/01/02/oil-prices-rise-as-iranian-warship-enters-red-sea-.html

https://inews.co.uk/news/red-sea-attacks-increase-uk-food-prices-2832471