Overview

What will increasing feedstock costs, and a stronger USD mean for polymer prices.

Prior to the US election result, European contract feedstock costs either settled with a rollover, or increases. The main driver for this price inflation was not demand, but the increase in crude oil and Naphtha pricing.

Crude Oil prices spiked in October as a result of geopolitical tensions in the Middle East and in particular the reprisals from Israel on Iran, following the previous missile attack on Israel by Iran. Fears that Israel might attack oil and gas, and or, Iranian nuclear infrastructure were not realised, and crude oil prices have since moderated to some extent.

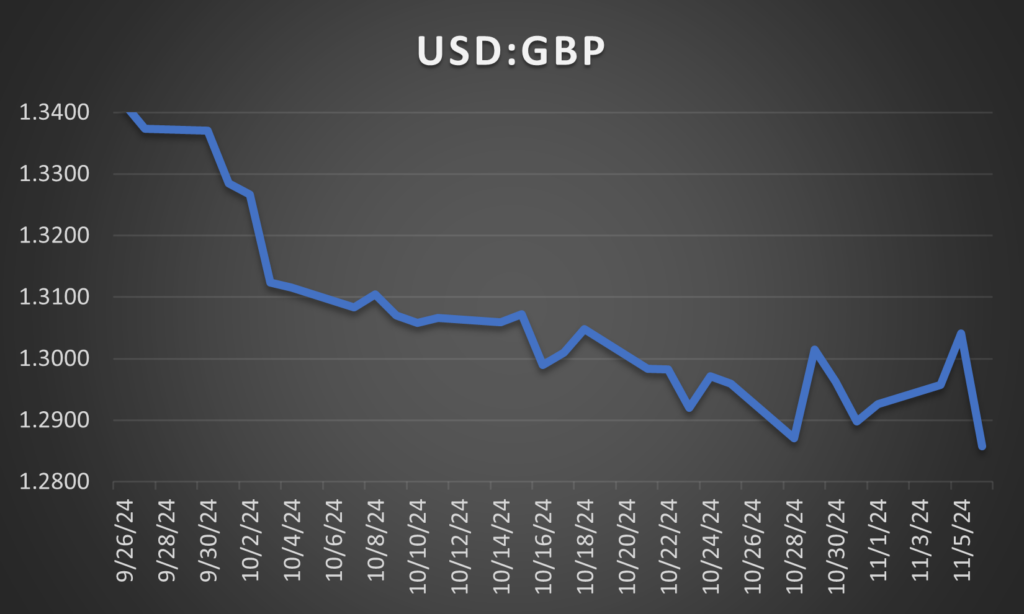

The leadup to the US election suggested that the outcome would be close, but Donald Trump won a decisive victory for the Republican Party and as a result the USD has strengthened. This will result in upward price pressure for both polymers sourced from the Far East and for PE directly imported from the US. The change from a USD:GBP 1.34 down to 1.29 equates to about £85 per tonne for PE. It remains to be seen if Republican Party policies bring further strength to the US economy.

With the lull in seasonal demand that affects the UK and Western Europe, the possibility of price increases taking effect before the new year would appear to be remote. The evolution of crude oil prices and exchange rates are likely to set an interesting backdrop for polymer supply in January and beyond.

Monomer Price Movement

Feedstock

Price per Tonne

Change (contract)

C2 (Ethylene)

£1,013.04

£25.27

C3 (Propylene)

£906.52

£20.89

SM (Styrene Monomer)

£1,182.23

£4.18

Benzene

£719.36

£46.79

Butadiene

£864.74

£0.00

Brent Crude (monthly average)

£435.90

£20.82

Exchange Rates

€

1.20

$

1.30

€/$

1.09

Mike Boswell

Managing Director – Plastribution Group

Oil Prices

No Data Found

Exchange Rates

No Data Found

UK Economic Data

Topic

Item

Date

Change

Trend

GDP

Real GDP (Q on Q)

Q2 2024

£639095

PMI

UK Manufacturing PMI

October

49.9%

UK Output

Manufacturing Index

September

106.2%

Sales

New Car Registrations (Y on Y)

October YTD

1,658,382

Sales

Retail Sales (Y on Y)

September 24

106.2%

Labour

Unemployment Rate

Jun 24 – Aug 24

4.0%

Prices

CPI (Y on Y)

September

1.7%

Prices

RPI (Y on Y)

September

2.7%

Interest Rates

Bank of England Base Rate

November

4.75%

Polyolefins

Polyolefin prices are mostly rolling over in November. Whilst Ethylene C2 and Propylene C3 both increased by €30 / MT and €25 / MT respectively, the market has resisted attempts to pass these increases through due to good availability and poor demand.

The outlook for December and for 2025 is for prices to be relatively flat to slightly down, but we continue to face some uncertainty. Whilst freight rates have dropped recently, they are on the way back up and with potential new tariffs on goods imported to USA in January, we may see a rush of demand for containers before they start.

Ian Chisnall

Product Manager – Polyolefins

Polyolefins Feedstocks

£/Metric Tonne by month

No Data Found

LDPE

Supply

Demand

LDPE is broadly a rollover with some movement depending on the starting point. Supply is reasonable but demand remains flat.

LLDPE

Supply

Demand

C4 LLDPE is rolling over into November with some slight pockets of tightness seen this month. However, in general market is well supplied, and demand continues to be weak.

Outlook for December and early 2025 is for more of the same with the global market oversupplied as new capacity coming on stream is not matched by stagnant demand.

HDPE

Supply

Demand

HDPE is rolling over, with some slight differences between the different grades.

Blow Moulding grades appear to have stronger demand, and prices are holding up better. Whereas Injection moulding grades appear to have better availability and prices are under a little bit more pressure. We should see strong supply of HDPE in 2025.

PP

Supply

Demand

PP pricing has rolled over into November with the monomer increase counterbalanced by increased levels of imports and low demand from key sectors.

Whilst food packaging continues to develop, other key sectors such Construction and Automotive are still struggling. PP availability may be disrupted in 2025 if container rates spike again.

Other Polyolefins

EVA pricing has rolled over. Polyolefin Elastomers are also rolling over.

Styrenics

Contract EU Styrene increases slightly, EU polymer steady.

Styrene Monomer has increased by just €5T, settling at €1415/T.

For November, EU GPPS, HIPS and ABS either rolled prices or followed the small increase.

GPPS/HIPS/ABS supply chains are still running very low. Polymer producers have been running output at a minimum due to poor demand, and converters and distributors running inventory at very low levels due to financial pressures. Therefore, any adjustments in polymer prices are likely to be passed on immediately.

Andrew Waterfield

Product Supervisor – Styrenics

Styrenics Feedstocks

£/Metric Tonne by month

No Data Found

PS

Supply

Demand

October SM fell steeply, with Monomer settling at €1410/T, a €202/T reduction on September. Supply remained normal, and the reduction triggered some converters to begin restocking, albeit not at forecasted levels, as overall demand was.

The small SM rise in November does little to change the situation, Supply is higher as all EU plants are up and running, but demand is still subdued

ABS

Supply

Demand

October prices fell (SM -€202/t, butadiene roll, ACN -€28/t). Supply was very good, but underlying demand in consumer sectors showed no signs of improvement.

Expectedly, November brings nothing new to the table. (SM +€5/t, butadiene roll, ACN +€41/t). We seem to be entering an area of oversupply, demand is restricted by the upcoming year end, and no appetite to builds stocks.

PC/ABS

Supply

Demand

As usual, PC/ABS price is following the trend of ABS, but supply/demand are not as extreme.

Other Styrenics

SAN and specialities such as ASA and Q Resin continue to follow the price trend of ABS.

Engineering Polymers

Demand remains weak so November will continue in the same theme as October. That means further cutbacks in production and downward pressure on prices for most engineering materials.

The November benzene contract settled €56/Mt higher than October at €861/Mt.

Sharron Jarvis

Product Supervisor – Engineering Polymers

Engineering Polymer Feedstocks

£/Metric Tonne by month

No Data Found

PA6

Supply

Demand

Low demand, high inventory levels and reducing prices.

PA66

Supply

Demand

Poor demand and no sign of recovery, so there are likely to be some further cost reductions.

POM

Supply

Demand

As with most engineering materials, weak demand is driving down prices.

PC

Supply

Demand

PMMA

Supply

Demand

PMMA is one of the few engineering materials that seems to be holding up in terms of pricing, but given the poor demand and increased imports, it remains to be seen for how long.

PBT

Supply

Demand

Weak demand and reducing prices.

Other Engineering Polymers

The current situation for most other engineering materials is similar, with weak demand and downward price pressure.

Sustainable Polymers

Recycled Polyolefins have mostly rolled over in November alongside prime prices.

There are some developments within the industry with a major recycling plant in the UK closing. We’ve also seen interesting developments with the recent budget.

The packaging tax is increasing in line with inflation and there will be changes to the rules on recycled content. When the new rules come into force, post-industrial content will no longer be eligible for packaging tax relief but they will allow chemical recycling to count.

Ian Chisnall

Product Manager – Sustainability

Recycled LDPE / LLDPE

Supply

Demand

Recycled LDPE / LLDPE has mostly rolled over in November. High-quality grades continue to see strong demand and restricted availability leading to prices keeping above virgin.

Recycled HDPE

Supply

Demand

Recycled HDPE is typically rollover with industrial grades continuing to be under pressure. Unclear as to how the Viridor closure will affect availability and pricing of HDPE going forward.

Natural grades for consumer packaging continue to see significant premiums over virgin prices.

Recycled PP

Supply

Demand

Recycled PP is rolling over in November. Prices are under some pressure with availability still good and demand slightly weak, but more specialised grades with tighter specification are holding up better.

As with other recycled grades, high quality natural commands a strong premium over virgin.