Overview

The attempts by polymer producers to push volume polymer prices forward in the second half of 2023 appear to have been thwarted. Not only did polymer converters consume existing inventories in order to resist buying higher price material, but both upstream and downstream demand was fundamentally weak.

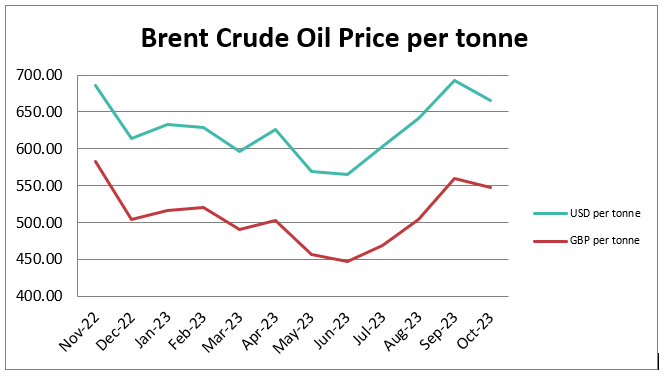

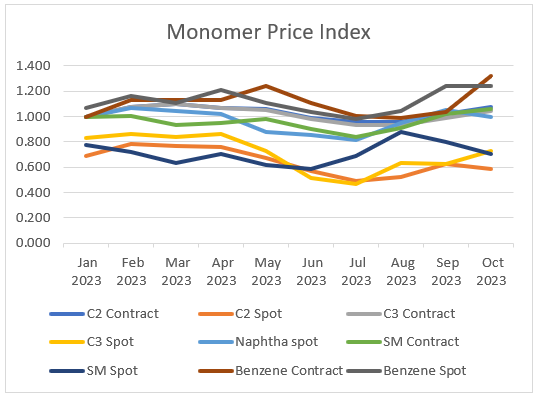

The upstream weakness is reflected in the across the board fall in contract monomer prices, which sharply contrasts with relatively stable crude oil prices and again the discount for spot over contract monomer costs are significant and the principle cause of contract price reductions. Weakness in downstream markets is evidenced by the UK and European markets suggesting that there is a significant risk of recession in 2024.

Most players remain confused by the lack of demand from converters with questions about substitution, supply chain destocking, fundamental shifts in consumer behaviour, and increased polymer production remaining unanswered.

The situation for engineering polymers remains largely unchanged, with suppliers still seeking to win market share through price competition.

Click the table above to zoom in.

Monomer Price Movement

Feedstock

Change (Contract)

C2 (Ethylene)

-£39.06

C3 (Propylene)

-£34.72

SM (Styrene Monomer)

-£129.34

Benzene

-£128.48

Brent Crude (monthly average)

-£12.52

Exchange Rate

1.15

Mike Boswell

Managing Director – Plastribution Group

Oil Prices

No Data Found

Exchange Rates

No Data Found

UK Economic Data

Topic

Item

Date

Change

Trend

GDP

Real GDP (Q on Q)

Q2 2023

£571,043

UK Output

Manufacturing Index

Q2 2023

107.2%

Sales

New Car Registrations (Y on Y)

September 23

153,529

Sales

Retail Sales (Y on Y)

August 23

117%

Labour

Unemployment Rate

May – July 2023

4.3%

Prices

CPI (Y on Y)

September

6.7%

Prices

RPI (Y on Y)

September

8.9%

Interest Rates

Bank of England Base Rate

November

5.25%

Polyolefins

After gaining ground in recent months, Polyolefin prices are falling back in November following the drops in monomers. Ethylene C2 dropped by €45 / MT and Propylene C3 dropped by €40. There were some initial attempts at the start of the month to limit reductions to a very optimistic rollover or a €20 / reduction but within a week, most market players had to concede and pass through the full monomer reduction.

PE and PP markets have seen a switch in fortunes this month with PE now appearing to be longer in supply and weakening in demand with PP showing more signs of a recovery in demand and availability being hit with a few minor issues.

With PE, after some tightness in September and October, there don’t appear to be any challenges in securing material to meet requirements. Imports are improving on the back of improving European pricing in recent months and low demand in the rest of the world. More shipments from USA and Middle East are arriving and more on the way for delivery in December and early 2024. With no expected interruptions to supply, most buyers are operating hand to mouth as further slight reductions are anticipated in December depending on the oil price and consequent downstream movement of monomers.

PP has stabilised a little after some months of volatility. PP Copolymer has seen a few shortages this month for specific grades as a handful of European plants experience unexpected interruptions. Propylene monomer has a few supply glitches at the start of the month but that appears to be resolved and should have no significant impact.

Outlook beyond November is for a slight decline in December depending on monomers and a hope, perhaps not quite an expectation from producers that this will be recovered in January. Some think that without a boost to economies to drive demand, the oversupply situation in both PE and PP Globally will continue to depress pricing and the aspirations of producers to restore margins to the black.

Ian Chisnall

Product Manager – Polyolefins

Polyolefins Feedstocks

£/Metric Tonne by month

No Data Found

LDPE

Supply

Demand

LDPE has fallen roughly in line with monomer depending on how strongly the seller pushed for increases in September and October.

Supply has stayed relatively stable, but demand has fallen with many converters running minimal stock in the run up to the end of the year.

LLDPE

Supply

Demand

C4 LLDPE has fallen in line with monomer but as with LDPE, it can vary depending on the level of price increases achieved in recent months. Imports are growing as traders and producers look for homes for the excess stock.

C6 LLDPE has lost much of its premium over C4 due to very good availability and Metallocene is suffering in a similar way with new players in the market looking to establish themselves in an increasingly crowded market.

HDPE

Supply

Demand

HDPE has dropped the €45 / MT monomer reduction in most cases, but HDPE is perhaps the only grade that has reported any tightness this month.

There are some reports of availability issues on HD Film.

PP

Supply

Demand

PP has slightly recovered in recent months after losing almost €300 / MT since the start of the year, but the rally has come to an end with the recent drop in monomer. Despite resistance, this has eventually been passed through.

Availability continues to be good, but the market has recovered sufficiently to restore a little bit of balance to the market.

Other Polyolefins

EVA pricing has moved in line with monomer. Polyolefin Elastomers appears to be stable as they are typically priced quarterly.

Styrenics

Contract Styrene Monomer Falls

Styrene Monomer has dropped, settling at €1486/T, a decrease of €149/T from a high point of €1635/T in October. The main driver was a €148/T fall in Benzene, and increased supply.

SM supply has improved, as the long-awaited US imports begin to arrive, and an EU plant has restarted.

For November, EU GPPS and HIPS has decreased by €120T, and EU ABS will decrease also.

GPPS/HIPS/ABS supply chains are running very low. Polymer producers have been running output at a minimum due to poor demand, and converters and distributors running inventory at very low levels due to financial pressures. Therefore, the adjustment in SM/PS prices is likely to be passed on immediately.

It is to be noted that the shift in EU styrene monomer is unlikely to have a large effect on Styrenic materials imported from the Far East, where prices have remained flat for the last few months.

Andrew Waterfield

Product Supervisor – Styrenics

Styrenics Feedstocks

£/Metric Tonne by month

No Data Found

PS

Supply

Demand

October contract SM rose by €60/T, with PS increasing by similar amounts. Monomer shortages impacted PS supply, where producers had been running at minimum output.

SM supply limitations have faded in November, and monomer drops (-€149/T) have pulled prices down, with GPPS and HIPS falling by €120/T. Availability is good, but demand is still weak.

ABS

Supply

Demand

October ABS saw increases of around €60/T for EU produced material as feedstocks pushed higher (SM +€60/t, butadiene +€ 70/t, ACN +€128/t).

November ABS reversed, driven by composite monomer drops (SM -€149/t, butadiene +€ 15/t, ACN +€27/t). Deep-sea material is more stable, but supply is still outstripping demand.

PC/ABS

Supply

Demand

As usual, PC/ABS price is following the trend of ABS.

Other Styrenics

SAN and specialities such as ASA and SMMA continue to follow the price trend of ABS.

Engineering Polymers

There is no significant change to the market with automotive, E&E, and construction all remaining quiet, and little change is expected as we start the rundown to the Christmas period. There are early signs of price increases on some raw materials, specifically for PA6, with increasing costs for caprolactam, however, with a stagnant market and plentiful inventories it will prove difficult to push through any increases.

The benzene contract settled €148/mt lower than in October.

Sharron Jarvis

Product Supervisor – Engineering Polymers

Engineering Polymer Feedstocks

£/Metric Tonne by month

No Data Found

PA6

Supply

Demand

November saw early announcements from some European producers of increases on the back of rising costs of caprolactam, but weak demand is likely to pause any chance of implementing them.

PA66

Supply

Demand

Extremely poor demand, cheaper imports, and downward pressure on prices.

POM

Supply

Demand

No real change on the horizon, cheaper imports from Asia and weak demand continue to put downward pressure on pricing.

PC

Supply

Demand

Demand remains weak in automotive and further pressure on prices with no change expected before the end of the year.

PMMA

Supply

Demand

Demand remains weak, downward pressure on prices with no immediate recovery expected anytime soon.

PBT

Supply

Demand

The outlook remains the same as other polymers, weak demand and over supply putting downward pressure on prices.

Other Engineering Polymers

The situation for other engineering polymers is broadly similar. Most materials are still reducing in price, the market remains weak and there is greater availability from cheaper Asian imports.

Sustainable Polymers

Most recycled materials have fallen in line with the changes in prime grades this month as demand continues to be weak and supply decent. Whilst there are few spots of tightness in the market for higher quality grades, converters are only buying their minimum requirements as we near the end of the year.

Ian Chisnall

Product Manager – Sustainability

Recycled LDPE / LLDPE

Supply

Demand

Recycled LDPE / LLDPE has risen dropped roughly in line with monomer but with some reports that clear and translucent grades are holding prices better than black and jazz.

Recycled HDPE

Supply

Demand

Recycled HDPE has also moved in line with prime material. Natural grades continue to command strong premiums above prime for specific applications such as household goods packaging.

At the other of the scale, there are reports of deals to move stock of “regran” for low value applications.

Recycled PP

Supply

Demand

Recycled PP has seen some slippage on pricing that reflects the movement in prime but some grades in niche applications are holding on to prices better.

The Automotive sector is showing some signs of recovery, and this is a key growth area for recycled PP. Some spot deals for general purpose grades with a broader specification are reported in the market.

Fully natural recycled PP continues to be sold well above prime pricing.