Overview

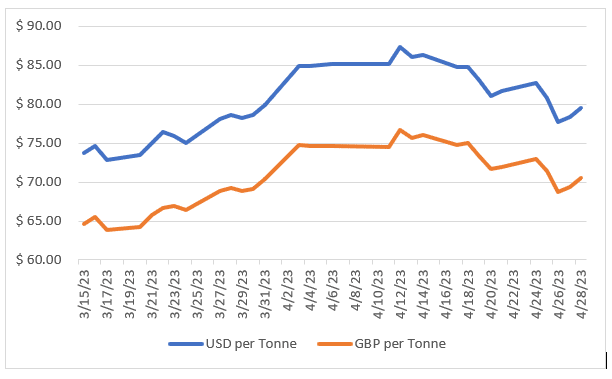

As depicted in the graph below, the spike in oil price at the end of March, caused by OPEC announcing a 1.2 million barrels per day cut back in production, was short-lived. Concerns about the global economic outlook dominated price action through the second half of April.

These concerns also dominated price action in the polymer raw materials sector with prices typically falling by amounts equal to, or in excess of, their respective monomer decreases from March to April. Overall, there was plentiful supply and sellers continued to discount prices in an attempt to secure orders.

Feedstock costs for May have settled with a smaller decrease for C2 and C3 compared to April, although the aromatics have moved up in price with Benzene continuing to be relatively volatile. It is noted that SM has only recorded part of the benzene gain, which in part may be explained by the C2 reduction, but more likely reflects the weakness of the PS market.

At the start of May, there is still the feeling that polymer supply is plentiful and that further price reductions are likely. On the other hand, polymer producers will be eager to restore the supply demand balance back in their favour and start moving prices back up, but this appears to be an unlikely scenario for May.

Monomer Price Movement

Feedstock

Change (Contract)

C2 (Ethylene)

-£8.81

C3 (Propylene)

-£13.22

SM (Styrene Monomer)

£48.47

Benzene

£78.44

Brent Crude

£12.30

Exchange Rate

1.13

Mike Boswell

Managing Director – Plastribution Group

Oil Prices

No Data Found

Exchange Rates

No Data Found

UK Economic Data

Topic

Item

Date

Change

Trend

GDP

Real GDP (Q on Q)

Q4 2022

£558,005

UK Output

Manufacturing Index

Q4 2022

102.6%

Sales

New Car Registrations (Y on Y)

March

18.2%

Sales

Retail Sales (Y on Y)

February

116.5%

Labour

Unemployment Rate

November – January

3.7%

Prices

CPI (Y on Y)

February

10.4%

Prices

RPI (Y on Y)

February

13.8%

Interest Rates

Bank of England Base Rate

March

4.25%

Polyolefins

May has seen further drops in Polyolefin pricing following the slight Monomer reduction of €10 / MT for Ethylene C2 and €15 / MT for Propylene C3.

Prices continue to vary between different products due to supply / demand balances. LDPE continues to see low demand and good availability and is typically falling around €50 / MT. However, HDPE appears to be a little bit more restricted in supply and is falling by monomer. PP is in a stronger position with Impact Copolymer resisting falls in some cases and European Production is scaled back and imports are not always to the right specification.

Outlook for June is currently looking like close to rollover as we reach the point where European Producers will not be able to continue competing with imports and will shut down production. Whilst these are not the lowest prices we’ve seen in recent history; Producers are facing significantly higher production costs than in 2020. Consequently, further price drops will be heavily resisted by Producers.

Ian Chisnall

Product Manager – Polyolefins

Polyolefins Feedstocks

£/Metric Tonne by month

No Data Found

LDPE

Supply

Demand

LDPE is readily available, and demand continues to be weak from key sectors such as flexible packaging. Prices are falling by around €50 / MT as market players compete for the limited opportunities.

LLDPE

Supply

Demand

C4 LLDPE is under slightly more pressure this month than in April as imports increased by more than local demand. Drops of €10-30 have been reported as buyers look for deals in a well-supplied market.

Metallocene prices and LLDPE C6 prices also fell as US imports looked for homes. Bigger discounts were available for large volume buyers.

HDPE

Supply

Demand

HDPE is a little mixed as some suppliers had limited availability and with a “take it or leave it” approach, insisted on rollover. However, like LLDPE C4, HDPE saw imports generally increase and with it, the prices have softened €10-30 / MT.

PP

Supply

Demand

PP pricing has held up remarkably well in May with the supply / demand balance on PP copolymer shifting ever so slightly towards tightness. Interest from buyers in PP Copolymer was stronger than in recent months and some Producers felt confident in asking for rollover.

Whilst imports from USA and Far East are arriving, the impact is lower than the PE market is experiencing as the European PP market is more reliant on approved grades. Homopolymer is less specified and has seen prices roughly fall with monomer.

Other Polyolefins

EVA pricing reduced with by slightly more than monomer as availability becomes better with some plants restarting production this month. Speciality POP grades fell with the monomer reduction.

Styrenics Feedstocks

£/Metric Tonne by month

No Data Found

PS

Supply

Demand

In April, SM trended slightly upward (+€19), but GPPS and HIPS only rose by €5/T on average, as producers were unable to pass on the full increases. PS supply remains the same as previous months, with output balanced with poor demand. Even with FM at a major French producer there was no shortage of supply. Easter holiday had a major effect on de

May SM has risen by €55/T, but GPPS/HIPS follows the same trend as April. There is no appetite from converters to accept increases, and demand remains as low, not assisted by multiple holidays in the UK. Supply is back to normal as the FM in France has ended.

ABS

Supply

Demand

Slight changes in ABS composite monomer costs (SM +€19/t, butadiene -€20/t, ACN -€154/t) in April indicated a €15/T drop, but in general prices rolled over, Supply is good, but Demand is low, not assisted by Easter holidays.

May ABS rolls over, with the market in no mood to accept price increases based on a slight increase in composite monomers (SM +€55/t, butadiene -€10/t, ACN +€67.5/t). Supply is still good, but Demand in May is still poor, not assisted by multiple holidays in the UK.

PC/ABS

Supply

Demand

As usual, PC/ABS price is following the trend of ABS.

Other Styrenics

SAN and specialities such as ASA and SMMA continue to follow the price trend of ABS.

Engineering Polymers

Sharron Jarvis

Product Supervisor – Engineering Polymers

Engineering Polymer Feedstocks

£/Metric Tonne by month

No Data Found

PA6

Supply

Demand

As with most engineering materials, demand remains very weak. European plants continue to cut back production, but with plentiful supply of imports from Asia prices are anticipated to fall further.

PA66

Supply

Demand

A similar picture to PA6, weak demand from the market and cheaper imports putting pressure on prices, no changes on the horizon.

POM

Supply

Demand

Reducing energy costs, low demand and cheap Asian imports continue to put pressure on pricing and the supply chain.

PC

Supply

Demand

PMMA

Supply

Demand

PMMA is coming under price pressure with cheaper imports from Asia and reducing energy costs. Producers are likely to have no choice but to lower prices.

PBT

Supply

Demand

Weak demand and reducing pricing with no change expected in the short to medium term.

Other Engineering Polymers

The situation for other engineering grades remains complex, all materials are reducing in price, and we are seeing greater availability from imports.