Update: New data source

Since the launch of Price Know-how in 2013 the data for the Styenics, Polyolefins and Engineering Polymer price baskets have been sourced externally. In 2023 this approach was reviewed and following careful evaluation it has been determined that Plastribution’s own internal data source provides equivalent information with the advantages of not requiring currency conversion and of being based upon actual UK transactions.

In order to provide continuity, the internal data will be applied to all polymer pricing information contained within Price Know-how from February 2024 onwards.

We hope that you continue to value the Price Know-how publication and we always welcome any suggestions you make.

Overview

Are markets about to tighten, as the economics of imports from other regions look increasingly unfavourable?

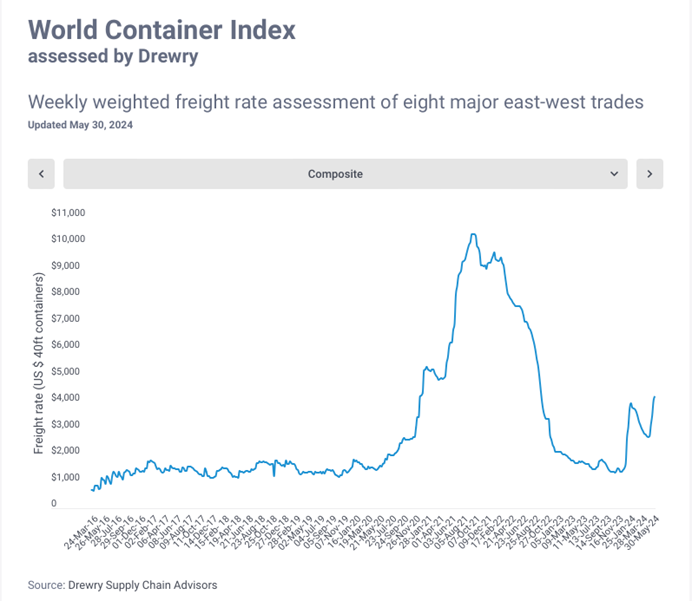

There is no doubt that falling polymer production input costs in terms of raw materials and energy are causing UK and European buyers to push for further price concessions. As shown in the table below both most feedstocks/monomers and crude oil prices remain under downward pressure. However, this is far from the complete picture as container shipping costs from Asia are again once again spiking, as Western retailers rush to import goods for anticipated seasonal demand from Black Friday promotions and the Christmas gifting season. Furthermore, there is a desire to ‘rush’ imports in an attempt to avoid the feared imposition of tariffs on the import of Chinese goods to the US, which may further be influenced by the outcome of the forthcoming US elections.

Remaining with the US, the import of US origin polyethylene is gaining significance in the European and UK markets, and it appears that US producers are taking a robust approach to pricing and referencing strong US domestic demand along with high local pricing to not only justify maintaining price, but in many cases pushing for increases, particularly where availability is viewed as already snug.

For many sellers, across a wide range of polymers, there is more of a view of ‘when’ rather than ‘if’ prices start to increase, although effects such as lower seasonal demand due to the summer holiday period, will need to be tempered with reticence to import US cargoes when the immediate economics do not look attractive. Ultimately, the market will determine what happens, but with supply chains looking quite empty, if a turnaround comes, the impacts could be quite significant.

Monomer Price Movement

Feedstock

Price per Tonne

Change (contract)

C2 (Ethylene)

£1,043.74

£25.67

C3 (Propylene)

£945.36

£25.67

SM (Styrene Monomer)

£1,4637.29

£25.67

Benzene

£1,152.00

£29.94

Brent Crude (monthly average)

£535.82

£34.30

Exchange Rates

€

1.17

$

1.26

€/$

1.08

Mike Boswell

Managing Director – Plastribution Group

Oil Prices

No Data Found

Exchange Rates

No Data Found

UK Economic Data

Topic

Item

Date

Change

Trend

GDP

Real GDP (Q on Q)

Q4 2023

£566,626

PMI

UK Manufacturing PMI

May

51.2%

UK Output

Manufacturing Index

Q1 2024

102.7%

Sales

New Car Registrations (Y on Y)

May 2024

827,500

Sales

Retail Sales (Y on Y)

April 24

114.6%

Labour

Unemployment Rate

Jan 24 – Mar 24

4.3%

Prices

CPI (Y on Y)

April

2.3%

Prices

RPI (Y on Y)

April

3.3%

Interest Rates

Bank of England Base Rate

May

5.25%

Polyolefins

Polyolefin prices are starting to stabilise in June with many considering this the bottom of the current pricing cycle. Both monomers, Ethylene C2 and Propylene C3 dropped €30 / MT and this change is mostly reflected in polymer pricing. Some producers initially looked for rollover, but most have passed on the reductions. There are some producers of PP in Force Majeure this month with very restricted availability and consequently didn’t see the need to offer reductions this month.

PP pricing is generally performing better than PE as the supply / demand balance is slightly better with limited European production and lower levels of imports. However, whilst PE has seen strong imports at the start of the year when pricing was better, these are drying up as producers in USA and Middle East see better returns elsewhere.

Freight rates are starting to become an issue with increases of $4,000 / container over the cost at the start of the year. This adds around £130-160 / MT on imports from the Far East. We’re also seeing disruption at ports in the Middle East affecting supply to Europe.

Overall, prices should stay quite flat for the summer. How strong a recovery, if at all, we see from September will depend on many factors around the world and how economies start to recover.

Ian Chisnall

Product Manager – Polyolefins

Polyolefins Feedstocks

£/Metric Tonne by month

No Data Found

LDPE

Supply

Demand

LDPE has followed the monomer change with prices typically down €30 / MT. Some tightness in the very low MFI grades has been reported and high MFI injection grades are also reported as restricted in availability.

LLDPE

Supply

Demand

C4 LLDPE does appear to have hit the bottom of pricing with the very low levels reported for USA imports in May disappearing as USA domestic prices increase.

This month has seen the monomer drop of €30 / MT passed through but reductions beyond that as we saw in the last few months now seem unlikely. Global logistics issues should see availability tighten a little though with demand still weak, prices will probably stay quite flat. C6 has good availability and isn’t commanding much of a premium over C4.

Metallocene continues to be in a very wide range with general purpose grades readily available at small premiums over standard C6 but highly specialised grades commanding €3-400 / MT premiums.

HDPE

Supply

Demand

HDPE is a bit like LLDPE, and we see increasing imports from USA and Middle East, but availability is a bit more limited and so reductions are more like €10-30 / MT.

PP

Supply

Demand

PP pricing has mostly followed the monomer down by €30 / MT. PP is seeing a lot of factors influencing availability and pricing. European production rates are at all-time lows as producers try and keep supply matched with demand. As mentioned in the overview, freight rates from Asia are much higher and containers are restricted in availability. This is limiting exports of PP from this region and pushing up costs for deliveries in the coming months.

Other Polyolefins

EVA pricing has mostly rolled over following heavy discounts given in recent months to stimulate demand. Polyolefin Elastomers and Plastomers are rolling over.

Styrenics

Contract Styrene Falls slightly, Polymer prices show small reduction.

Styrene Monomer has fallen again, settling at €1680/T, a decrease of €30/T from April.

For June, EU GPPS and HIPS has fallen, with EU ABS remaining flat. Deep sea materials have rolled, but increasing shipping costs could impact future trends.

GPPS/HIPS/ABS supply chains are still running very low. Polymer producers have been running output at a minimum due to poor demand, and converters and distributors running inventory at very low levels due to financial pressures. Therefore, any adjustments in polymer prices are likely to be passed on immediately.

Andrew Waterfield

Product Supervisor – Styrenics

Styrenics Feedstocks

£/Metric Tonne by month

No Data Found

PS

Supply

Demand

May saw a €111/T decrease in Styrene monomer, and PS followed.

June continues the trend, with SM falling by €30/T, and PS prices reduce by €5-€10/T. Supply and demand are both low, so remain in equilibrium. Due to this supply chains are empty; any price changes are immediate.

ABS

Supply

Demand

Composite Monomers trend reversed in May (SM -€111/t, butadiene +€45, ACN -€4). Supply and demand were still low, but availability improved, as far eastern materials, delayed by red sea issues, began to arrive. Demand was throttled by high prices.

June prices have stabilised (SM -€30/t, butadiene +€25, ACN -€40), but demand remains stagnant as converters may wait for the bottom of the market. Shipping cost from the far east are on the rise. These costs are currently being absorbed, but could drive prices upwards in the coming weeks.

PC/ABS

Supply

Demand

As usual, PC/ABS price is following the trend of ABS.

Other Styrenics

SAN and specialities such as ASA and Q Resin continue to follow the price trend of ABS.

Engineering Polymers

Demand overall remains relatively weak and the supply chain plentiful for most engineering materials. With the June benzene contract settling €35/mt higher it is likely that most prices will rollover in June, with only PMMA and possibly POM & PC facing an upward trend.

The Benzene contract for June settled €35/mt higher at €1152/mt.

Sharron Jarvis

Product Supervisor – Engineering Polymers

Engineering Polymer Feedstocks

£/Metric Tonne by month

No Data Found

PA6

Supply

Demand

Demand remains fairly low, and with the recent reduction in the benzene contract and lower energy costs, most producers had to settle for rollover at best. The outlook for June is not great with flat prices the most likely result.

PA66

Supply

Demand

The situation for PA66 is similar to PA6, with supply outstripping low demand. Prices mostly rolled over despite a modest increase in butadiene pricing. June will probably end up around rollover, despite a €25/mt increase in the June butadiene contract, as the market remains gloomy.

POM

Supply

Demand

There was little appetite for cost rises in May, but June may bring modest price rises due to increased freight costs and availability from Far East sources reducing due to lack of container availability.

PC

Supply

Demand

PMMA

Supply

Demand

It is expected that PMMA prices will rise in June due to ongoing supply restrictions and disruptions to logistics. Whilst demand remains on the low side, producers are standing firm and insisting on cost increases.

PBT

Supply

Demand

There is a small chance that PBT prices may be on the rise due to freight costs and logistics issues, but demand is low and not expected to increase, meaning that rollover may be the more likely outcome.

Other Engineering Polymers

The current situation for most other engineering materials is similar, as we still see the impact on lead-times from the challenges of much reduced container availability, particularly from the Far East, affecting supply. This, coupled with rapidly rising freight costs may mean higher prices and whilst some increases have been announced these are proving difficult to push through due to ongoing sluggish demand.

Sustainable Polymers

Recycled materials have seen around rollover into June with higher performance grades seeing increasing demand but lower quality grades seeing an oversupply situation.

Ian Chisnall

Product Manager – Sustainability

Recycled LDPE / LLDPE

Supply

Demand

Recycled LDPE / LLDPE has seen a mixed picture in June with natural, tight specification grades seeing increases of around €20 / MT based on continued strong bale input costs and improving demand. However, lower quality grades continue to see good availability and are typically falling in line with Prime prices.

Recycled HDPE

Supply

Demand

Recycled HDPE is performing relatively well in June with natural blow moulding grades suitable for consumer packaging continuing to command a significant premium over Prime as brands look to push their “Green” marketing. Black and jazz grades are still under pressure with good availability and weak demand from key sectors such as construction.

Recycled PP

Supply

Demand

Recycled PP is around rollover into June, natural grades still command a strong premium over Prime with demand beyond current output, natural PP can be €400 / MT over the price of Prime. Black grades are relatively balanced, automotive grades are performing OK despite low demand in that sector as demand for more recycled content in cars increases.