Overview

Demand in June remained weak and polymer supply was plentiful. Given the high levels of inventory on the supplier side there was plenty of competition as sellers looked to move inventory through the supply chain in order to both clear warehouse space and generate cash. Some deals on volume polymers resulted from the need to create physical storage space so that containerised imports could be cleared from port in a timely manner in order to avoid expensive demurrage charges.

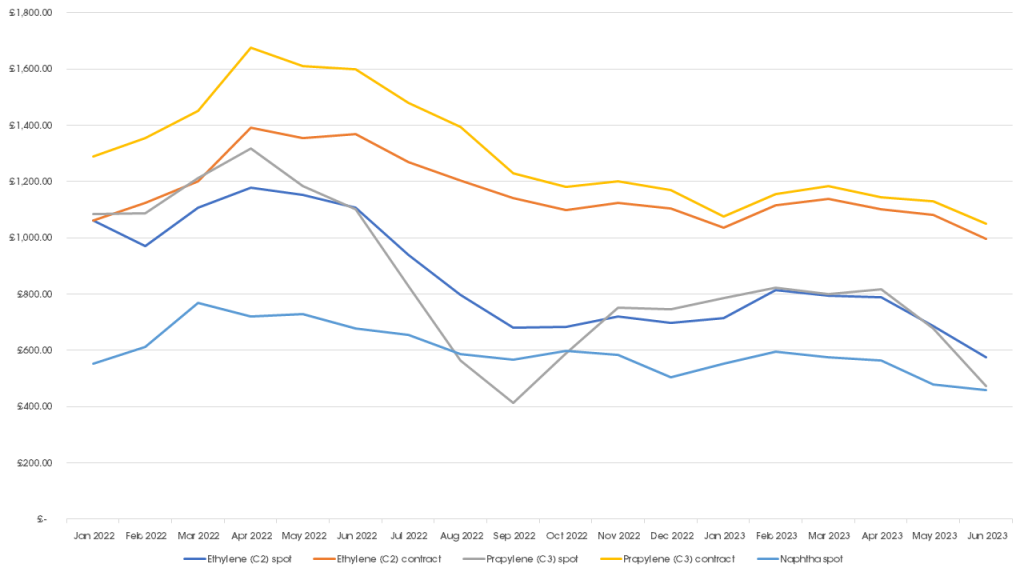

Large converters saw price reductions for volume polymers in June greater than the respective drop in contract feedstock. The economics of this are largely based upon the relative fall in spot monomer costs, through which polymer producers who purchase feedstock on a spot basis could take advantage of very low input cost. The following graph clearly depicts the difference between spot and contract C2 and C3 since the beginning of January 2022 when the deltas were effectively nil. The current spot price of C2 and C3 against Naphtha does not look sustainable and as has been the case with polymer production will likely lead to the idling of further Naphtha cracking capacity.

Monomer Price Movement - June

Feedstock

Change (Contract)

C2 (Ethylene)

-£69.68

C3 (Propylene)

-£69.68

SM (Styrene Monomer)

-£110.62

Benzene

-£95.82

Brent Crude

-£47.00

Exchange Rate

1.15

Monomer Price Movement - July

Feedstock

Change (Contract)

C2 (Ethylene)

-£34.34

C3 (Propylene)

-£42.93

SM (Styrene Monomer)

-£74.70

Benzene

-£67.83

Brent Crude

-£9.21

Exchange Rate

1.16

The July feedstock contracts have again fallen from the June levels, albeit a more moderate reduction. In the case of volume polymers, it appears that the bountiful supply is enabling large polymer converters to take full advantage of these reductions and in some cases further discounts have been negotiated.

The situation for more specialised polymers is mixed, with strong competition from Far East imports for some of the more standard grades of POM and PC, where converters have the flexibility to use a variety of materials. In the case of speciality grades, suppliers will do as much as possible to work through higher priced inventory before passing through cost reductions in full or part.

Whilst at this point the market sentiment looking forwards into August is likely to be the same, there is the need for some caution, because as producers idle more and more capacity there will come a tipping point at which inventories will be depleted and demand will exceed supply. There are some indications that some of the large converters who are speculative buyers are starting to increase inventories as they see the market approaching ‘the bottom point’ and many players are indicating that the end of August may represent the tipping point.

Mike Boswell

Managing Director – Plastribution Group

Oil Prices

No Data Found

Exchange Rates

No Data Found

UK Economic Data

Topic

Item

Date

Change

Trend

GDP

Real GDP (Q on Q)

Q1 2023

£558,812

UK Output

Manufacturing Index

Q1 2023

105.4%

Sales

New Car Registrations (Y on Y)

June 23

177,226

Sales

Retail Sales (Y on Y)

May 23

116.9%

Labour

Unemployment Rate

February – April 2023

3.8%

Prices

CPI (Y on Y)

May

8.7%

Prices

RPI (Y on Y)

May

11.3%

Interest Rates

Bank of England Base Rate

June

5%

Polyolefins

Whilst not quite as dramatic as June, July has seen further falls in Polyolefin pricing though typically more in line with the monomer reductions this month. Ethylene C2 dropped €40 / MT and Propylene C3 dropped €50 / MT.

Market is still very well supplied and with poor demand in key sectors, it continues to be a buyer’s market. Some suggestions that we are close to the bottom of the market with these reductions being the last of any significance this year. Whilst August may see relatively flat conditions, there are expectations of a small price recovery in September or October

But the fundamentals of polymer supply and demand are still not great. Virtually all European plants are running at technical minimums with millions of tons of capacity taken out this year. But this is more than offset by significant new capacity around the world for both PE and PP.

Warehouses in the main European hubs are reported to be full and with more product on the way, traders are looking to secure deals to move volume to converters.

However, there are suggestions that much of the Polymer Supply “Pipeline” is running quite empty with many participants in the value chain (converters, distributors, end users etc.) holding the minimum stock possible. Whilst it is currently still possible to run on a “Just In Time” basis with strong supply, it wouldn’t take much of a blip to disrupt this fine balance.

Ian Chisnall

Product Manager – Polyolefins

Polyolefins Feedstocks

£/Metric Tonne by month

No Data Found

LDPE

Supply

Demand

LDPE is readily available, and demand continues to be weak. Prices have fallen further than monomer again this month and LDPE continues to be the cheapest of all the PE and PP grades. There are rumours of plant shutdowns coming in Europe this month and next to try and limit availability so this may be the low point of the market.

LLDPE

Supply

Demand

C4 LLDPE has also dropped by around the monomer reduction of €40 / MT, but the pricing is very varied depending on supplier and timescale. But continued strong imports, especially from USA are squeezing prices further.

HDPE

Supply

Demand

HDPE continues to be the most resilient PE grade although like LLDPE, is seeing increasing imports driving prices down. HD injection appears to be the longest grade and is falling by more than monomer whilst Blow Moulding and Film are more in line with the monomer reduction of €40 / MT.

PP

Supply

Demand

PP appears to be performing slightly better than PE with PP Copolymer in particular enjoying slightly improved demand in some sectors. With some supply issues in the European markets with Force Majeures and unscheduled maintenance, some buyers struggled to secure required volumes. Whilst this has seen some tiny flecks of optimism in some quarters, prices are still falling in line with monomer going into July

Homopolymer has been under more pressure with demand not as strong and availability still good. Falls beyond monomer are typical and the gap to Copolymer has widened again to around €100 / MT.

Other Polyolefins

EVA pricing continues to fall significantly with demand in Europe way below supply as capacity returns to the market. Reductions of almost €100 / MT were reported.

Speciality type grades also fell as we entered a new quarter and whilst these grades are typically more resilient, demand is down across the board and special deals were available to stimulate demand.

Styrenics Feedstocks

£/Metric Tonne by month

No Data Found

PS

Supply

Demand

June SM fell by €127/T, and GPPS/HIPS followed, with 3-digit discounts possible. Supply remained good, even with production at a minimum, and rumours of some plants closing. Demand remained low.

July brings a further drop in SM of -€87/T, and the supply/demand situation remains unchanged. As the holiday period approaches it seems unlikely this will change.

ABS

Supply

Demand

June ABS saw a reduction of around €105/T. Oversupply was an issue, even with EU plants throttled, but demand remained poor, even at a lower price point.

July brings further reductions as monomers dropped again (SM -€87/t, butadiene -€ 70/t, ACN -€80/t). Oversupply still stands, and demand is held back by a weak economy and high interest rates, restricting any appetite for inventory building.

PC/ABS

Supply

Demand

As usual, PC/ABS price is following the trend of ABS.

Other Styrenics

SAN and specialities such as ASA and SMMA continue to follow the price trend of ABS.

Engineering Polymers

Sharron Jarvis

Product Supervisor – Engineering Polymers

Engineering Polymer Feedstocks

£/Metric Tonne by month

No Data Found

PA6

Supply

Demand

Weak demand sees further production cutbacks at European plants. Prices continue to fall, and more reductions in price are expected in the coming months, with no change in market conditions expected until quarter four.

PA66

Supply

Demand

A similar picture to PA6, extremely poor demand, cheaper imports, and downward pressure on prices, with no changes on the horizon.

POM

Supply

Demand

Cheaper imports from Asia continue to put downward pressure on pricing and the supply chain. Production in Europe remains low to mirror the poor demand from the automotive sector and other market segments

PC

Supply

Demand

The Benzene contract has reduced further by €89 per metric tonne this month. We continue to see cheaper imports arriving which is driving the price down. Weak demand means European plants are cutting back production, but it is doing little to stop the erosion in price.

PMMA

Supply

Demand

Cheaper imports from Asia continue to put pressure on prices. Poor demand in all segments, especially automotive, which is not expected to improve until after the holiday period.

PBT

Supply

Demand

Weak demand and reducing prices, with no change on the horizon.

Other Engineering Polymers

The situation for other engineering grades remains complex, all materials are rapidly reducing in price, and we are seeing greater availability from imports.