Overview

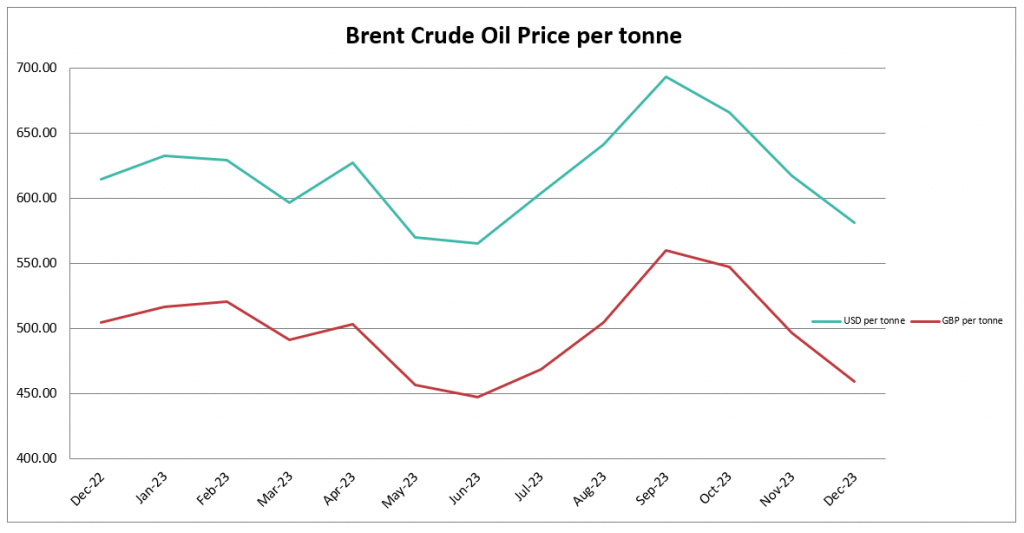

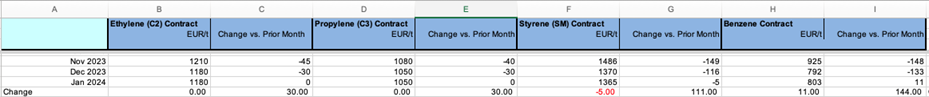

It is interesting to note that the reduction in Brent Crude, and a similar reduction in Naphtha pricing has not been passed through to contract monomer pricing in January, with both C2 and C3 pricing rolling over and SM only taking a small net decrease, versus an uplift in Benzene costs.

Despite the international shipping issues affecting both the Red Sea and Panama Canal, the crude oil markets appear to be unphased by the consequent shipping delays, which suggests that local inventories are sufficient to cover anticipated demand. However, there is a growing expectation that the increased transit times for goods from both the Middle East and Asia into Western Europe may cause some restrictions in polymer availability.

In particular shipments PE and PP from the Middle East are expected to face delays and supplies of ABS and engineering polymers from Asia are also likely to be affected. Furthermore, and in contrast to the crude oil markets, the Drewry composite World Container shipping index has rapidly spiked as concerns develop regarding capacity restrictions emanating from longer shipping times.

The capability of local inventory, along with inbound shipments from other sources such as the US, to meet demand will ultimately determine if some tightness develops in the polymer market. It should also both be pointed out that the shipments are delayed and not cancelled, and furthermore if shipping routes return to ‘normal’ there is a consequent risk of a material glut as lead-times reduce. The rollover on feedstocks may also be an indicator that the market has bottomed out and that there could soon be some attempts at price increases.

Given the relatively flat demand profile in January, it is likely to be an interesting month as both sellers and buyers continue to monitor business conditions carefully.

The situation for engineering polymers remains largely unchanged, with suppliers also seeking to win market share through price competition.

Click the table above to zoom in.

Monomer Price Movement

Feedstock

Change (Contract)

C2 (Ethylene)

£0.00

C3 (Propylene)

£0.00

SM (Styrene Monomer)

-£4.31

Benzene

£9.49

Brent Crude (monthly average)

-£37.22

Exchange Rate

1.16

Mike Boswell

Managing Director – Plastribution Group

UK Economic Data

Topic

Item

Date

Change

Trend

GDP

Real GDP (Q on Q)

Q3 2023

£568,953

PMI

UK Manufacturing PMI

December

46.2%

UK Output

Manufacturing Index

Q3 2023

102.2%

Sales

New Car Registrations (Y on Y)

December 23

1,903,054

Sales

Retail Sales (Y on Y)

November 23

118.5%

Labour

Unemployment Rate

May – July 2023

4.3%

Prices

CPI (Y on Y)

November

3.9%

Prices

RPI (Y on Y)

November

5.3%

Interest Rates

Bank of England Base Rate

November

5.25%

Polyolefins

Polyolefin prices have stopped falling in January and have either rolled over in line with monomers or are increasing slightly depending on the grade, the starting point and if replenishments are expected to be impacted by shipping disruption in the Red Sea.

Some producers who are predominantly based in the Middle East are already talking about delays and possible shortages in Europe in the coming months. Shipments from the Far East are looking at 3 to 4 week delays, and this has changed the approach of some who are no longer looking to sell stocks quickly. Whilst the impact is not being felt yet, there is already a growing sentiment that increases of €50-100 are likely in February.

The counterbalance to this is continued low demand in China and whilst we will see issues in getting material from A to B, we are still in a Global oversupply situation. Whilst a February increase is likely as we face some short-term disruption, we can expect to see prices stabilise after a few months once these issues are factored in.

Ian Chisnall

Product Manager – Polyolefins

LDPE

Supply

Demand

LDPE is not particularly dependent on imports into Europe and is not as significantly affected by the shipping issues. Prices have generally rolled over in January.

Whilst it was a little bit tight in December, supply does now seem to be reasonably well matched with demand. Likely to see increases in February as the overall PE market is expected to go up.

LLDPE

Supply

Demand

C4 LLDPE has rolled over in most cases but with some small (€20-30 / MT) increases from some producers based on their limited availability.

We rely quite heavily on imports from Middle East and USA and increases in February are very likely on the back of reported price increases in USA and delays in shipments from the Middle East. One producer has already indicated +€100 for February LLDPE C4 coming from Middle East.

C6 LLDPE will also be affected but the price rises in USA are more of an influence. Metallocene PE will see an impact from reduced imports (South Korea, Middle East) and USA imports will be more expensive.

HDPE

Supply

Demand

HDPE has broadly rolled over with some small increases. As with other PE grades, increases are likely in February, especially for grades out of the Middle East. Demand is slightly up on December levels and delays to imports are likely, so expect to see a bit of tightness in the market in February and prices rising accordingly.

PP

Supply

Demand

PP has started to see increases already of around €30 / MT on PP Copolymer as imports from South Korea are expected to be hit and some European Producers have low inventories following some unplanned issues at the end of 2023. Further increases are expected in February.

Homopolymer is more stable and seems to mostly be rollover for now but will face upward pressure in February particularly on the lower end of the market.

Other Polyolefins

EVA pricing has moved down as although monomers rolled over, EVA is in an oversupply situation and consequently, producers are offering €50 / MT discounts to encourage buying. Polyolefin Elastomers are relatively stable in line with monomer.

Styrenics

Marginal fall for Contract Styrene, Polymer prices roll but Shipping Issues cause short term hike.

Styrene Monomer has dropped for three months in a row, settling at €1365/T, a decrease of €5/T from December. The main driver was poor demand. SM production is not expected to resume until 2nd week of January, but this is not expected to cause any supply issues.

For January, EU GPPS and HIPS rolled over, with EU ABS following. Deep sea materials are showing an increase, as the Red Sea issues increase shipping costs, but it is hoped this will be short term.

GPPS/HIPS/ABS supply chains are running very low. Polymer producers have been running output at a minimum due to poor demand, and converters and distributors running inventory at very low levels due to financial pressures. Therefore, any adjustments in polymer prices are likely to be passed on immediately.

Andrew Waterfield

Product Supervisor – Styrenics

PS

Supply

Demand

December delivered falls with SM sliding downwards by €116/T, causing a drop of around €140/T for GPPS and HIPS. Supply remained low, and the Christmas holidays pressed demand down to very low levels. No issues with supply.

January shows little change, SM dropped by a nominal €5/T, and PS saw increases of €5/T. Supply is good, but there are no signs of a recovery in demand.

ABS

Supply

Demand

December ABS fell, driven by composite monomer drops (SM -€116/t, butadiene -€ 10/t, ACN -€28/t). Demand was extremely poor.

Small changes to this trend are expected in January as EU ABS rolls (SM -€5/t, butadiene Roll, ACN TBC). Deep-sea material is facing increases due to extended shipping routes, potentially short term. Supply is still outstripping demand, but it is hoped there will be some demand stimulus mid-month as converters begin to restock.

PC/ABS

Supply

Demand

As usual, PC/ABS price is following the trend of ABS.

Other Styrenics

SAN and specialities such as ASA and Q Resin continue to follow the price trend of ABS.

Engineering Polymers

The indications for January are that prices may have reached the bottom, however, most producers have taken a cautious approach and rolled prices over. The Red Sea crisis is likely to see prices increasing in the coming weeks and months due to extended shipping times and rising fuel costs, as vessels are redirected adding additional miles to their routes.

Sharron Jarvis

Product Supervisor – Engineering Polymers

PA6

Supply

Demand

Announcements for January are rollover but with shorter validity due to the challenges of the redirection of vessels away from the Red Sea and possible increased costs in raw materials and shipping.

PA66

Supply

Demand

A similar picture to PA6, demand remains weak in the automotive sector and inventories are still plentiful.

POM

Supply

Demand

Like other materials we may start to see increases due to the Red Sea crisis.

PC

Supply

Demand

PMMA

Supply

Demand

No notable change in demand from automotive sector as we move into the new year. Most producers have announced price reductions for quarter one.

PBT

Supply

Demand

Only minor changes anticipated, as weak demand continues to put downward pressure on prices.

Other Engineering Polymers

Most materials are likely to be impacted by the challenges of the Red Sea situation. We could see increases due to delayed raw materials and increased costs from shipping lines.

Sustainable Polymers

Most recycled materials have rolled over into January in line with Prime materials. Supply and Demand appear to be slightly better balanced with some reports of an uptick in interest as the market anticipates Prime prices to increase in February

Ian Chisnall

Product Manager – Sustainability

Recycled LDPE / LLDPE

Supply

Demand

Recycled LDPE / LLDPE is so far looking like rollover from December, but some producers are talking small increases as they see some increase in demand throughout Europe.

Recycled HDPE

Supply

Demand

Recycled HDPE is also looking like rollover though there is some slight up and down depending on the grade, quality and application. Natural prices for higher quality consumer goods packaging are up whilst lower quality grades are rollover and, in some cases, discounts can be discussed.

Recycled PP

Supply

Demand

Recycled PP has some variability depending on the quality and the end use but broadly seems to be rollover. The expected disruption to Prime availability is leading some suppliers to reconsider offers and some lower priced spot deals are being withdrawn.

Can expect to see increases in February depending on how the Prime price moves and the level of disruption to supply.