Update: New data source

Since the launch of Price Know-how in 2013 the data for the Styenics, Polyolefins and Engineering Polymer price baskets have been sourced externally. In 2023 this approach was reviewed and following careful evaluation it has been determined that Plastribution’s own internal data source provides equivalent information with the advantages of not requiring currency conversion and of being based upon actual UK transactions.

In order to provide continuity, the internal data will be applied to all polymer pricing information contained within Price Know-how from February 2024 onwards.

We hope that you continue to value the Price Know-how publication and we always welcome any suggestions you make.

Overview

As outlined in the January edition of Price Know-how, there have been a range of implications for polymer pricing resulting from the Houthi terrorist attacks on shipping in the Red Sea. The biggest impact has been where local European inventories are low in comparison to demand and also where the lead-time is most significantly impacted. In practical terms this is affecting PE and PP where significant volumes consumed in the European region are either produced in the Middle East, or the Far East and typically material moves through the shorter Suez Canal shipping route.

As with Crude Oil, there is the perception that local European stocks of engineering polymers and speciality polymers are sufficient to cover the effects of any shipment delays and therefore upwards price pressure is less acute. That said the shipping delays are now not the only issue, with bunker fuel shortages resulting in some ships returning to port of origin and others missing port stops entirely in order to avoid congestion and/or to save the fuel needed to take the longer Cape of Good Hope shipping route to European port destinations. This additional burden on logistics will likely result in further tightening of product availability, probably affecting a broader range of materials.

Another factor affecting availability is a series of force majeures impacting upon local European polymer production. It is interesting to note that suppliers of material from the Middle East are bullish with regard to passing through the increased cost of shipping to European converters; commonly stating that if ‘net backs’ are better from other regions they will divert material from Europe to these more lucrative markets.

Any shortage of supply in Europe still appears to be transitory, as other regions of the world continue to look well supplied, which leaves polymer converters facing a dilemma on their purchasing strategies in order to cover requirements whilst at the same time mitigating the risk of ending up with over-priced inventory.

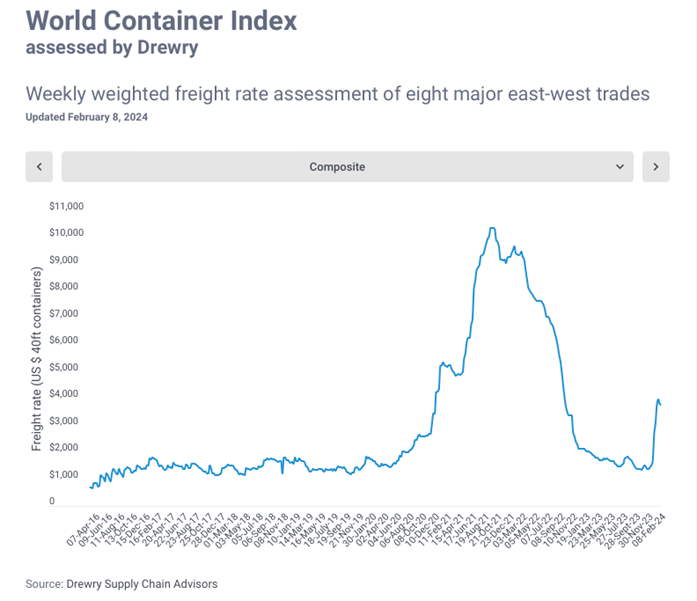

The peak in the Drewry World Container Index for eight major east-west trades is welcome and makes good sense in terms of the Red Sea situation being a smaller scale issue that the shipping challenges created by the global Covid-19 pandemic.

The increase in C2 and C3 contract prices for February are insignificant compared to the respective changes in PE and PP prices that have taken place in January and February and is a clear demonstration that supply/demand balance can independently affect each step in the polymer production process from Crude Oil (Energy), monomers and intermediates, through to polymers.

Benzene and SM tend to be volatile and given that a greater portion of these products are shipped around the world it is likely that the Red Sea situation is impacting prices.

Monomer Price Movement

Feedstock

Price per Tonne

Change (contract)

C2 (Ethylene)

€1,185.00

€4.29

C3 (Propylene)

€1,065.00

€12.88

SM (Styrene Monomer)

€1,555.00

€163.10

Benzene

€1,017.00

€183.70

Brent Crude (monthly average)

€469.43

€10.22

Exchange Rates

€

1.16

$

1.27

€/$

1.09

Mike Boswell

Managing Director – Plastribution Group

Oil Prices

No Data Found

Exchange Rates

No Data Found

UK Economic Data

Topic

Item

Date

Change

Trend

GDP

Real GDP (Q on Q)

Q3 2023

£568,953

PMI

UK Manufacturing PMI

January

47%

UK Output

Manufacturing Index

Q3 2023

102.2%

Sales

New Car Registrations (Y on Y)

December 23

1,903,054

Sales

Retail Sales (Y on Y)

December 23

113.8%

Labour

Unemployment Rate

May – July 2023

4.3%

Prices

CPI (Y on Y)

December

4.0%

Prices

RPI (Y on Y)

December

5.2%

Interest Rates

Bank of England Base Rate

February

5.25%

Polyolefins

Polyolefin prices have risen strongly in February as the market saw a sudden shift in sentiment as the Red Sea shipping disruption impacted availability. Monomers saw modest increases of €5 / MT for C2 and Ethylene and €15 / MT for C3 Propylene, but these are largely irrelevant this month save for those in monomer linked contracts. All PE and PP grades saw significant increases of at least €150 / MT with some grades (LDPE) increasing by €200-250 / MT as demand significantly outstripped the immediate availability.

Buyers who had become used to readily available materials found themselves scrabbling for supply and the prices reflected this as producers and traders saw an opportunity to restore the margins lost towards the end of 2023.

These levels are likely to be relatively short lived as we are still in a global oversupply situation. Depending on who you ask, we are likely to see a return to January levels sometime between March and May as supply chains adapt and availability matches demand again.

Ian Chisnall

Product Manager – Polyolefins

Polyolefins Feedstocks

£/Metric Tonne by month

No Data Found

LDPE

Supply

Demand

LDPE has seen the biggest increases this month. Although not as affected by the Red Sea issues as other PE grades, local production / availability is not meeting demand.

LDPE production has suffered from a lack of Ethylene availability with some crackers in Europe down. A lot of European producers now have order stops in place, though material can still be obtained at a premium.

LLDPE

Supply

Demand

C4 LLDPE has generally increased by around €150 / MT depending on the starting point in January.

We’re very dependent on imports from the Middle East for LLDPE and the Red Sea shipping issues are affecting these supply routes. USA imports are also more limited following the big freeze and producers seeking better returns from other regions around the world.

Other grades of LLDPE (C6 and Metallocene) are also rising by roughly €150 / MT as buyers unable to source C4 look for alternatives. Metallocene has become tighter in recent weeks as South Korean and USA imports are delayed or reduced in volume.

HDPE

Supply

Demand

HDPE has also risen by roughly €150 / MT though whilst demand is strong, this is seen as the grade with the best availability out of the PE family. Trader stocks appear to have been boosted with some North American imports towards the end of last year. We’re still dependent on imports from the Middle East so this just could be a delayed issue that may be more acute in March.

PP

Supply

Demand

PP has also increased at least €150 / MT with many buyers reporting supply issues and delays to orders. European supply is very challenged this month with several producers either in Force Majeure or facing production issues.

We also rely on imports from the Far East for PP and these shipments are either delayed or not coming at all. This tightness on PP could persist for longer than PE with longer supply chains and more demands on the limited supply.

Other Polyolefins

EVA pricing has moved up though not as strongly as other PE grades as availability is much better with continued poor demand in European markets. Polyolefin Elastomers are a mixed picture with some stable and others following the price increases of the standard PE/PP grades.

Styrenics

Large Hike for Contract Styrene, Polymer prices Follow and Shipping Issues add to the Increase.

Styrene Monomer has risen, settling at €1555/T, an increase of €190/T from January.

For February, EU GPPS and HIPS followed, with EU ABS showing similar rises. Deep sea materials are showing an increase, as costs generated by the Red Sea issues cab no longer be absorbed by producers. This is expected to have an effect for the first half of 2024

GPPS/HIPS/ABS supply chains are still running very low. Polymer producers have been running output at a minimum due to poor demand, and converters and distributors running inventory at very low levels due to financial pressures. Therefore, any adjustments in polymer prices are likely to be passed on immediately.

Andrew Waterfield

Product Supervisor – Styrenics

Styrenics Feedstocks

£/Metric Tonne by month

No Data Found

PS

Supply

Demand

January showed little change, SM dropped by a nominal €5/T, and PS saw increases of €5/T. Supply was good, but there were no signs of a recovery in demand.

February brings a €190/T increase in Styrene monomer, and PS has risen by €150/T, with producers not passing on the full increase, possibly in an attempt to maintain demand. Supply is normal.

ABS

Supply

Demand

Small changes were seen in January as EU ABS rolled (SM -€5/t, butadiene Roll, ACN TBC). Deep-sea material faces increase due to extended shipping routes. Supply outstripped demand, but there was some demand stimulus mid-month as converters begin to restock, as increases loomed on the horizon.

As expected, February ABS has seen strong rises, with EU material pushed up by the SM rise, and Deep sea grades inflated by the need to pass on extra shipping costs. (SM +€190/t, butadiene +€100, ACN +€20).

Heavy restocking by converters in January could translate into low demand for February. Lead times are longer, but there is no issue in securing volumes.

PC/ABS

Supply

Demand

As usual, PC/ABS price is following the trend of ABS.

Other Styrenics

SAN and specialities such as ASA and Q Resin continue to follow the price trend of ABS.

Engineering Polymers

The Red Sea crisis continues to impact transit times, shipments from Asia are now exceeding three months lead-time into the UK. Prices are rising for most engineering materials due to increased fuel costs as vessels are directed away from the area around the Cape of Good Hope.

Sharron Jarvis

Product Supervisor – Engineering Polymers

Engineering Polymer Feedstocks

£/Metric Tonne by month

No Data Found

PA6

Supply

Demand

Price increase announcements were made but many producers have taken a more cautious approach and are now offering rollover for February, mainly due to the weak market and full inventories.

We still face the challenges of the rerouting of vessels around Africa, and increased fuel costs which will continue to put pressure on prices.

PA66

Supply

Demand

A similar picture to PA6, demand remains weak in the automotive sector and inventories are still plentiful.

POM

Supply

Demand

We are starting to see increases due to rising costs and longer lead-times. These are proving difficult to pass on with low demand and plentiful inventories.

PC

Supply

Demand

PMMA

Supply

Demand

No real recovery as yet from the automotive sector. Most producers have announced price reductions for quarter one and are keen to do deals.

PBT

Supply

Demand

Weak demand continues to put downward pressure on prices.

Other Engineering Polymers

Most materials are likely to be impacted by the challenges of the Red Sea situation. We are starting to see increases due to delayed raw materials and increased costs from shipping lines.

Sustainable Polymers

Most recycled materials have seen increases in February on the back of some very strong increases in Prime prices. Whilst +€150 / MT is out of the question, increases of €30-80 / MT have been reported as buyers unable to secure prime stocks looked for alternatives.

Ian Chisnall

Product Manager – Sustainability

Recycled LDPE / LLDPE

Supply

Demand

Recycled LDPE / LLDPE has seen strong increases in February as Prime grades rose to levels not seen since the start of 2023. Good quality recycled material now became an option for those struggling to secure prime LDPE.

Recycled HDPE

Supply

Demand

Recycled HDPE also saw increases though perhaps not as strongly as LDPE/LLDPE. Colourable, higher-quality grades suitable for blow moulding of personal care packaging saw stronger increases compared to black grades.

Recycled PP

Supply

Demand

Recycled PP rose by around €50 / MT as buyers looked for alternatives to either increasingly expensive or simply not available prime grades. Colourable grades were perhaps above this with black compounds possibly a bit below.