Price Know-How:

Review & Outlook - 2023 / 2024

2023 Review

Executive Summary

The economy in 2023 was dominated by the effects of the global economic slowdown. Relatively high levels of price inflation present in the first half of the year started to moderate towards the end of the year. In addition to the continuing conflict between Russia and Ukraine, the terrorist attack by Hamas on Israel and the subsequent conflict in Gaza raised geopolitical tensions in the Middle East, and at the very end of the year Houthi terrorist action against commercial shipping in the Red Sea, raised concerns about supply chain security and shipping costs. Energy prices moderated from the hiatus in 2023.

In the polymer markets the price trend continued lower. All sectors witnessed supply exceeding demand, a situation which for many materials was exacerbated by producer capacity increases. A small price upswing, for volume polymers, in the Autumn was not sustained as producers fought hard to win available volumes. Prices have now fallen to the extent that polymer producers termed the situation as ‘bottom of cycle economics’ resulting in idling and closure of plants where the financial performance is no longer viable. This effect was more pronounced in Western Europe, due to the higher cost of operating polymer plants in this region, which will inevitably result in a greater dependence on imports.

In the energy sector the risk of global recession continued to outweigh geopolitical concerns that could affect the supply of oil and gas. Even the disruptions caused to shipping routes by the actions of the Houthi rebels at the very end of the year had negligible impact on pricing, as markets took the view that domestic inventories were sufficient to cover any delays in shipments.

Despite the challenges of 2023, the UK plastics sector has once again demonstrated resilience in the face of significant challenges.

Mike Boswell

Managing Director – Plastribution Group

UK Economy, Brexit, and Post-Covid 19 Pandemic

Contrary to the expectations of many economists, the UK avoided recession in 2023 and modest growth was reported. Inflation was a dominant issue with RPI and CPI peaking above 10% before moderating towards the end of the year.

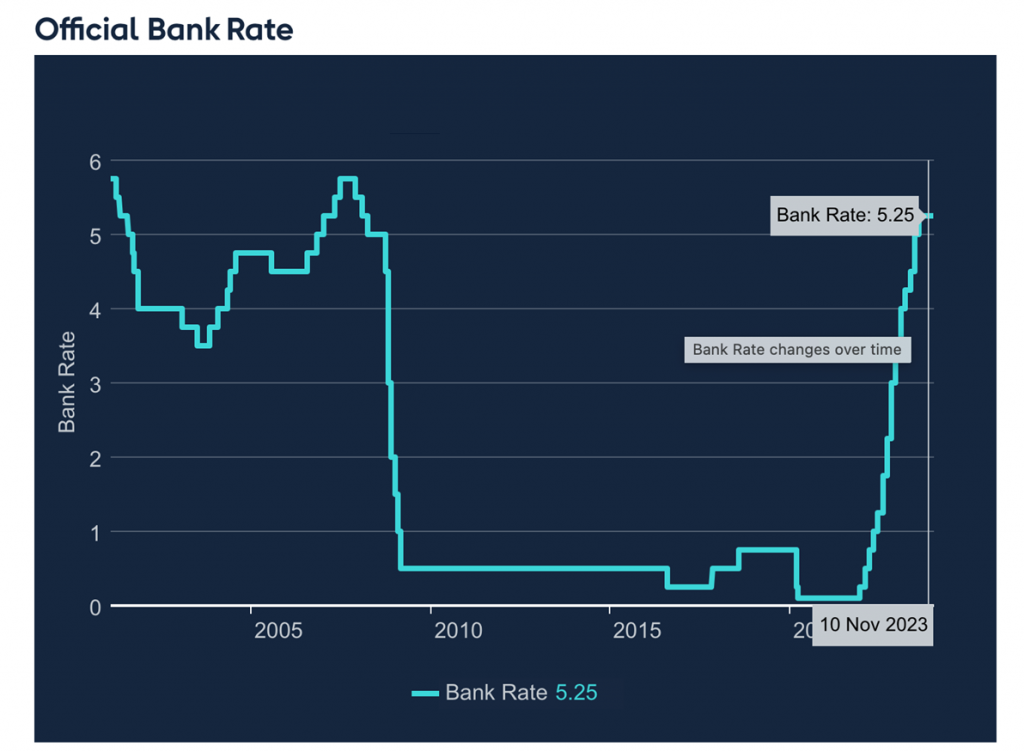

For plastic converters the falling cost of raw material inputs mitigated the impact of inflation. Interest costs appear to have peaked with a 5.25% Bank of England rate and there is some evidence of lenders in the domestic mortgage sector becoming more competitive in order to secure business.

Understanding the fundamentals of demand in the post Covid-19 era remains a challenge; it is clear that there was a significant move in consumer spending during the lockdown periods towards consumer durables. Since Covid-19 restrictions have lifted consumers have relied upon their previous investments in goods and are clearly continuing to prioritize spending on leisure activities such as holidays and dining out. Given long lead times on goods sourced from Asia, the drop in demand resulted in a glut of product, and when this is combined with the move back to ‘just in time’ from ‘just in case’ purchasing strategies it was almost impossible to understand true underlying demand.

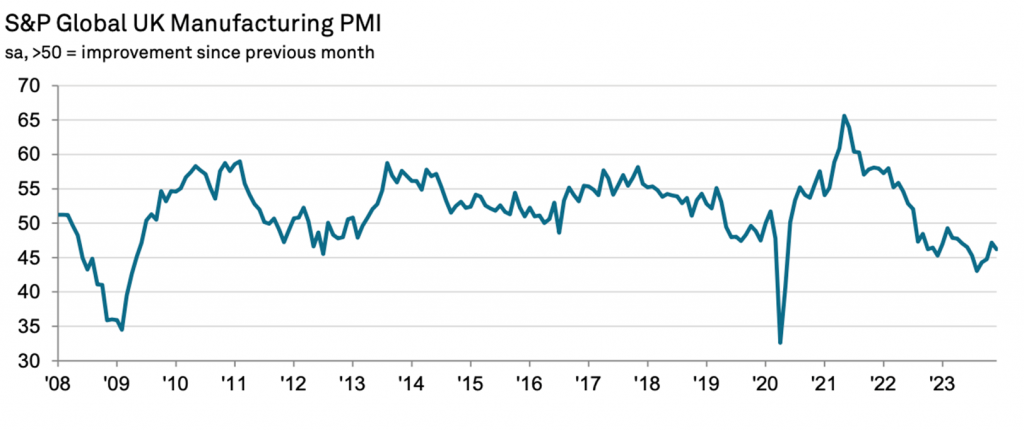

As a result of low demand, destocking and the move to ‘just in case’ purchasing the UK Manufacturing PMI fell month on month throughout 2023.

The S&P Global / CIPS UK Manufacturing PMI®, published on 2nd January 2024, included the following commentary

Business optimism dips to 12-month low.

The UK manufacturing sector ended 2023 on a weak footing. The downturn in production volumes accelerated as intakes of new work from both domestic and export clients declined. The further slide in output volumes reflected overstocking at clients and tighter inventory policies at manufacturers. The support provided by efforts to clear backlogs of work was also less effective than in recent months.

The seasonally adjusted S&P Global UK Manufacturing Purchasing Managers’ IndexTM (PMI®) fell back to 46.2 in December, after rising to a seven- month high of 47.2 in November, staying beneath the neutral 50.0 mark for the seventeenth consecutive month.

All five of the PMI sub-indices (new orders, output, employment, stocks of purchases and suppliers’ delivery times) remained at levels signalling a deterioration in operating conditions.

Manufacturing production declined for the tenth successive month in December, as downturns in the consumer and intermediate goods sub- industries more than offset expansion in the investment goods category. Output was scaled back in response to weaker intakes of new business, reduced demand from overseas and efforts to trim stocks at both manufacturers and their clients alike.

The total volume of new business placed with UK manufacturers fell for the ninth month running in December. Companies reported a weak economic backdrop, clients delaying orders and poor weather conditions had all contributed to the latest decrease in new work received. That said, the rate of contraction eased for the fourth month in a row to its slowest since May.

Logistics

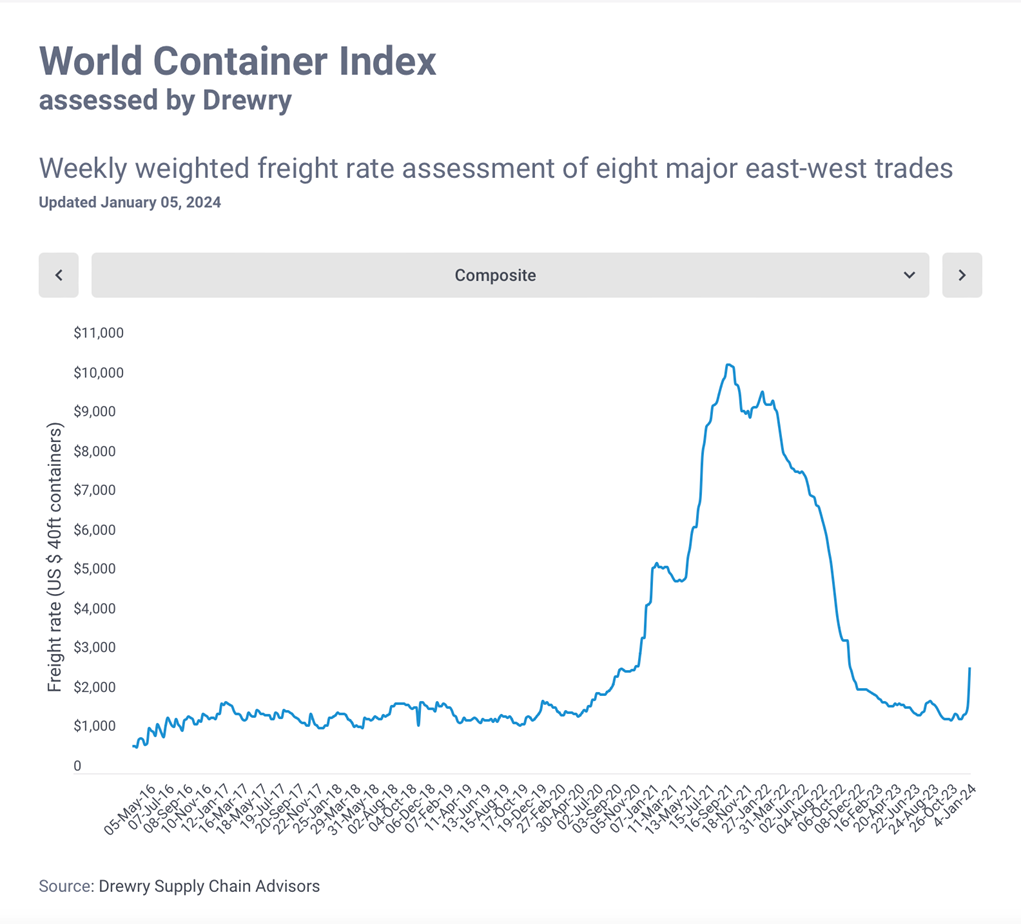

Since the extreme inflation in East-West container shipping rates that peaked in mid-2022, prices fell back to more normal levels in 2023, as illustrated in the table below. High shipping costs in the context of typical polymer prices can become prohibitive for polymer raw material imports and can become a barrier from the perspective of importing more competitively priced polymer from other regions of the world.

Spot container shipping rates from Asia and the Middle East increased rapidly at the end of the year due to the hijacking attempts, by Houthi rebels, on ships passing through the red sea, and the subsequent increase in shipping times and consequent reduction in container shipping capacity.

Within the UK, the shortage of HGV drivers has eased significantly, with a combination of more drivers and the economic slowdown both contributing to better availability of resources.

Exchange Rates

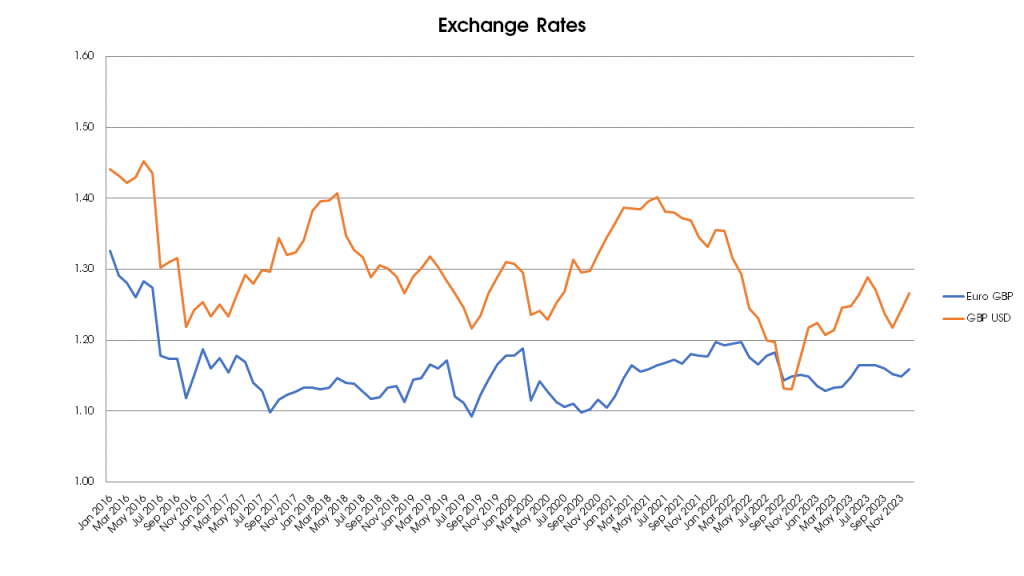

Following the short-lived Liz Truss premiership and the ensuing Kwasi Kwarteng autumn statement/’mini budget back in 2022, the value of the GBP has recovered significantly, achieving a reasonable level of stability against the Euro, and achieving gains against a slightly weaker USD.

The result of the June 2016 Brexit referendum has permanently impacted the value of the GBP, with the value against the Euro dropping from the 1.30’s to the 1.10’s. The USD turbulence is more related to political and economic developments within, and outside of, the US.

In the last 15 years, interest rates in the UK have increased significantly, as the Bank of England takes action to reduce inflation from the current rates to the target level which is below 2%.

Whilst the objective is to reduce consumer spending, businesses who raise working capital through borrowing are also facing significant increases in the cost of financing.

Crude Oil

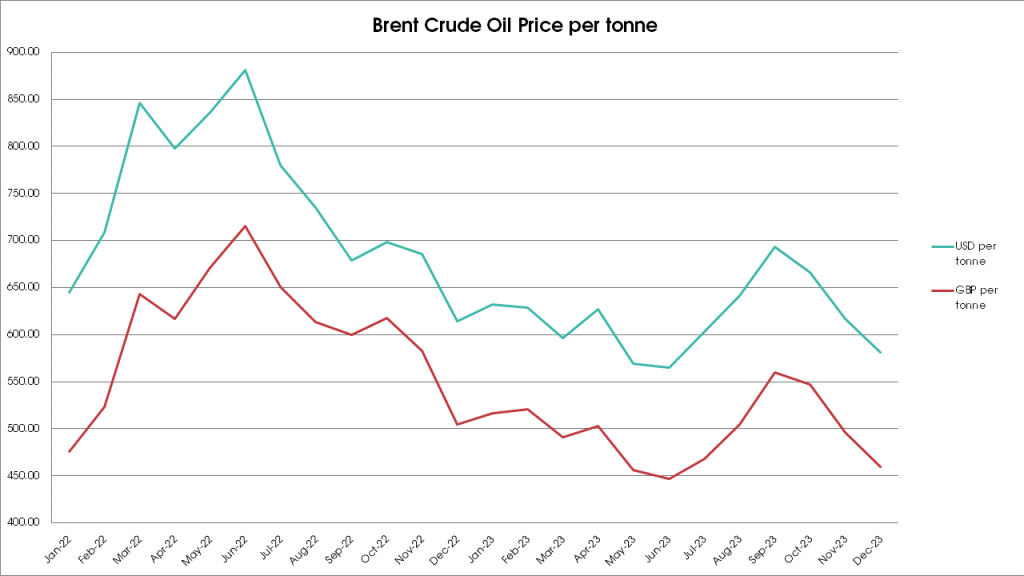

Brent Crude traded in a relatively tight range of 75 – 90 USD per barrel. Prices fell until mid-2023 before a short rally over the summer months, and then fell sharply back to levels that were below those at the start of the year.

The reaction of crude oil prices to the issues in the Red Sea area at the end of the year were quite muted, with a view that domestic inventories and increased supply from Saudi Arabia would be sufficient to smooth any disruption.

Feedstock

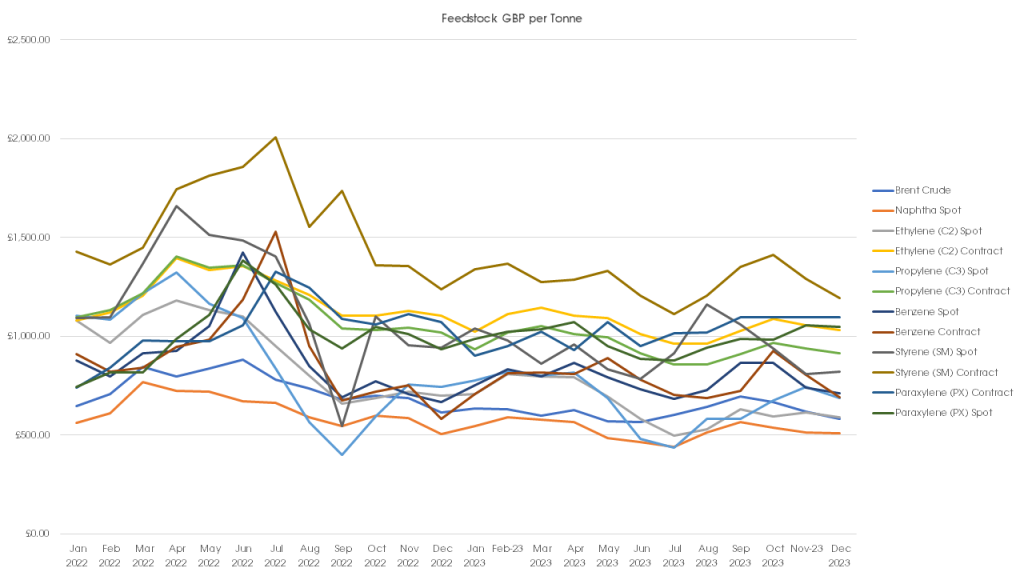

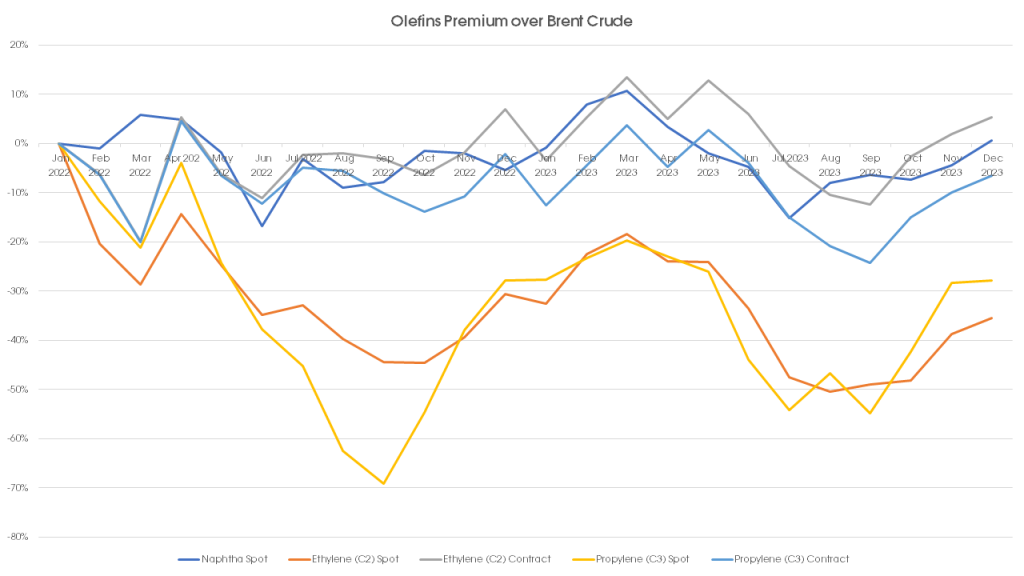

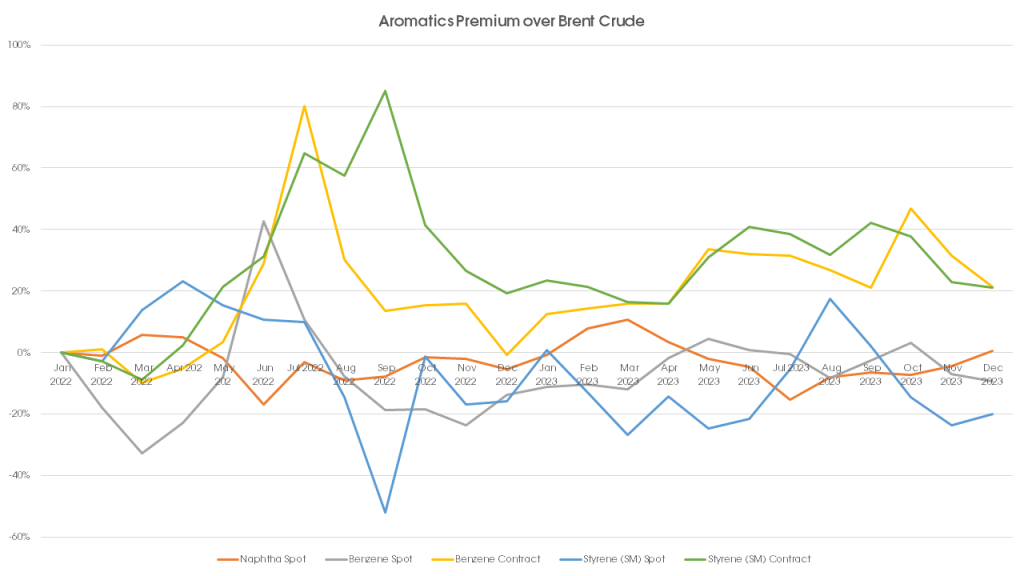

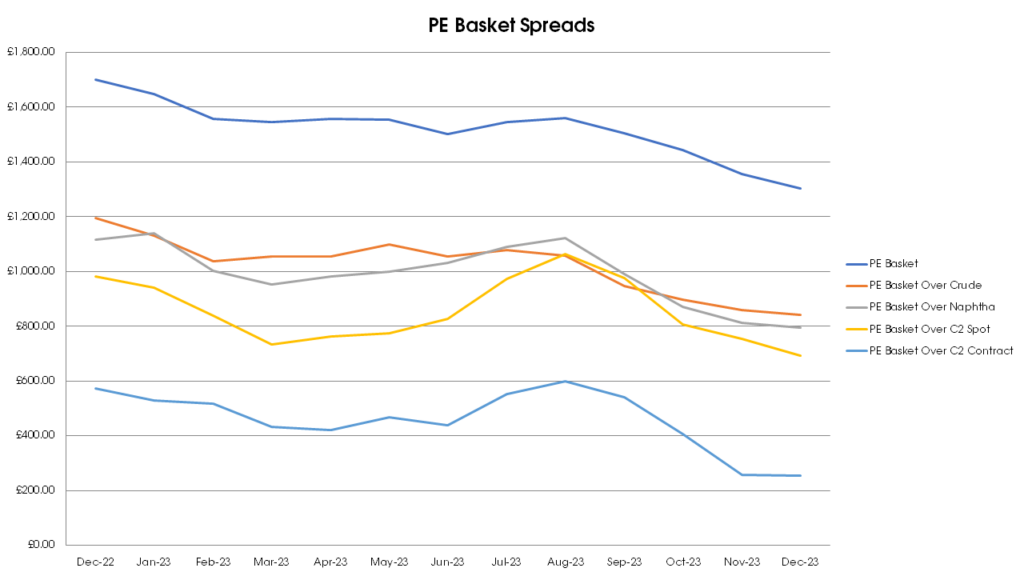

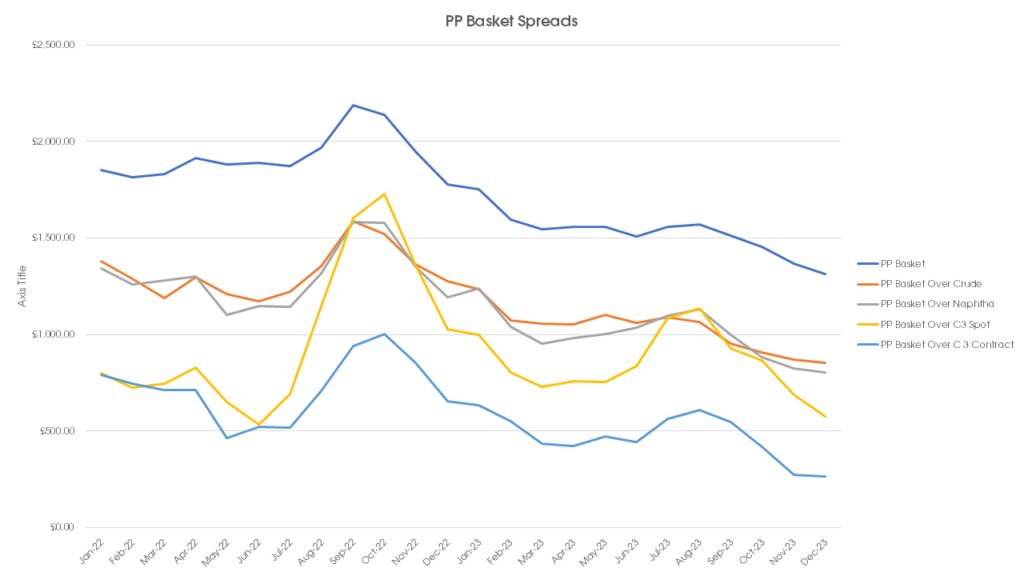

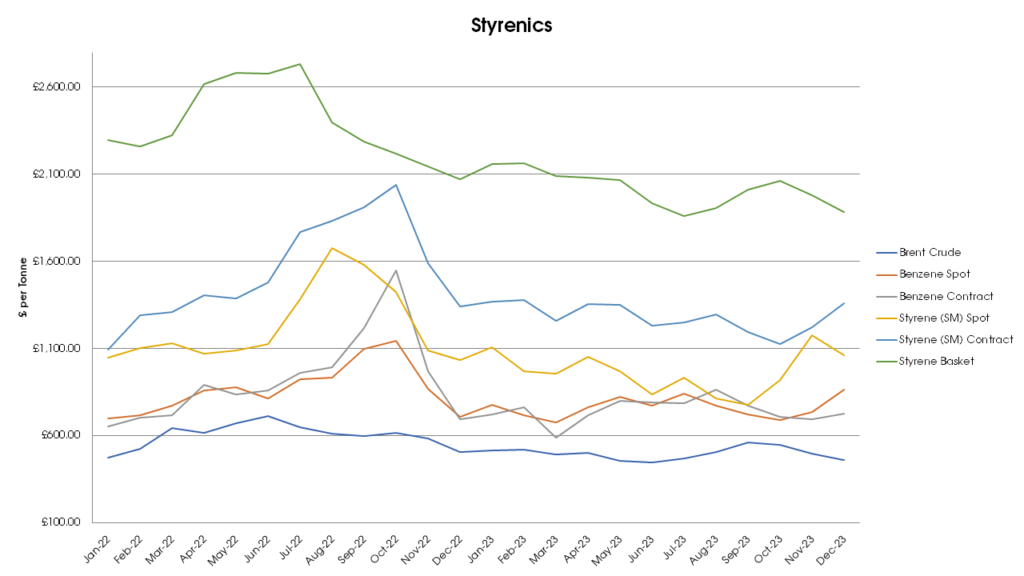

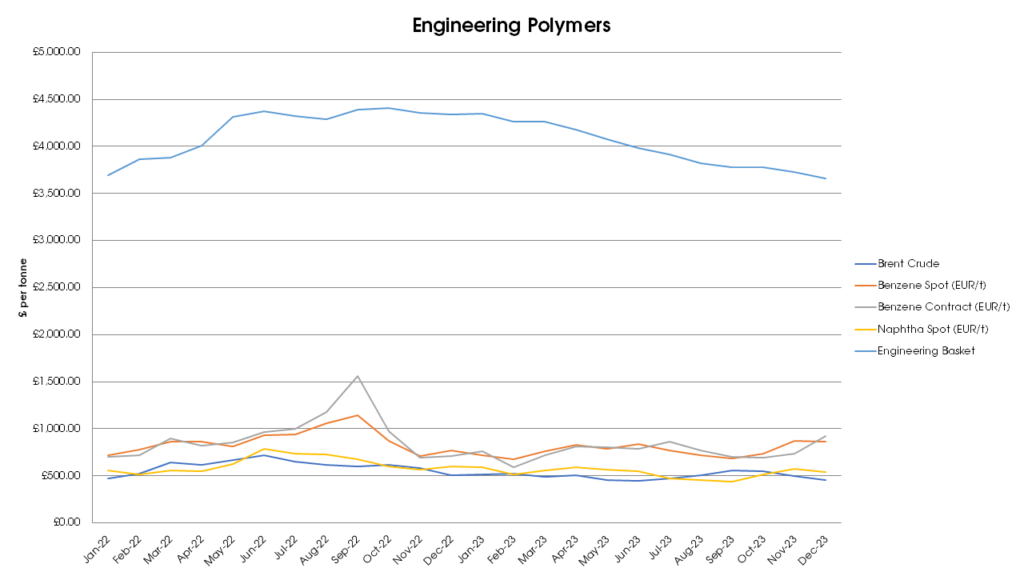

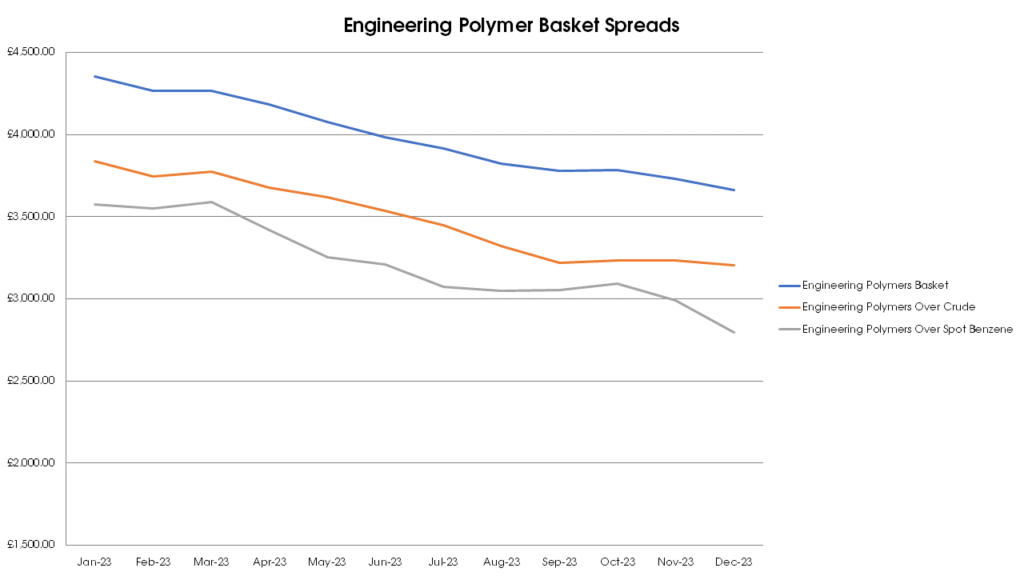

The volatility of aromatic feedstock continued in 2023, with both Benzene and Styrene monomer recording significant swings, which are often independent of Brent Crude and Naphtha. The olefin situation was dominated by over-supply, with spot prices trading at a significant discount to the contract values.

In the case of C2 high import penetration of competitively priced PE, suppressed demand, and although C3 is typically a coproduct of Naphtha cracking from C2 production, the reduction was insufficient to avoid a glut of C3 and hence the large discounts for spot purchases.

Such was the state of demand for polymer raw materials, that producers were typically forced to pass through monomer discounts in full, with polymer converters typically resisting full monomer increases and often able to achieve discounts greater than monomer as competition for available volumes was intense.

The graph above clearly confirms the oversupply of both C2 and C3 with spot volumes selling at significant discounts versus Naphtha. Even contract monomer margins were dragged down by spot pricing; this is especially evident for C3 in the late summer period.

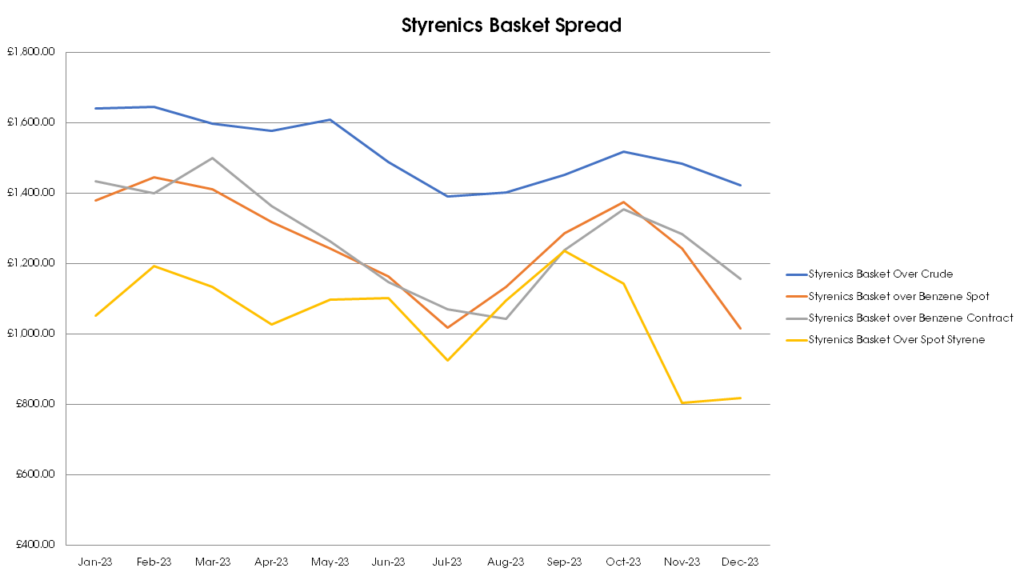

The graph below clearly illustrates the relative volatility of aromatic feedstocks, with periods of discount and significant premium. The past year has been more stable, with SM peaking in August on the back of supply restrictions.

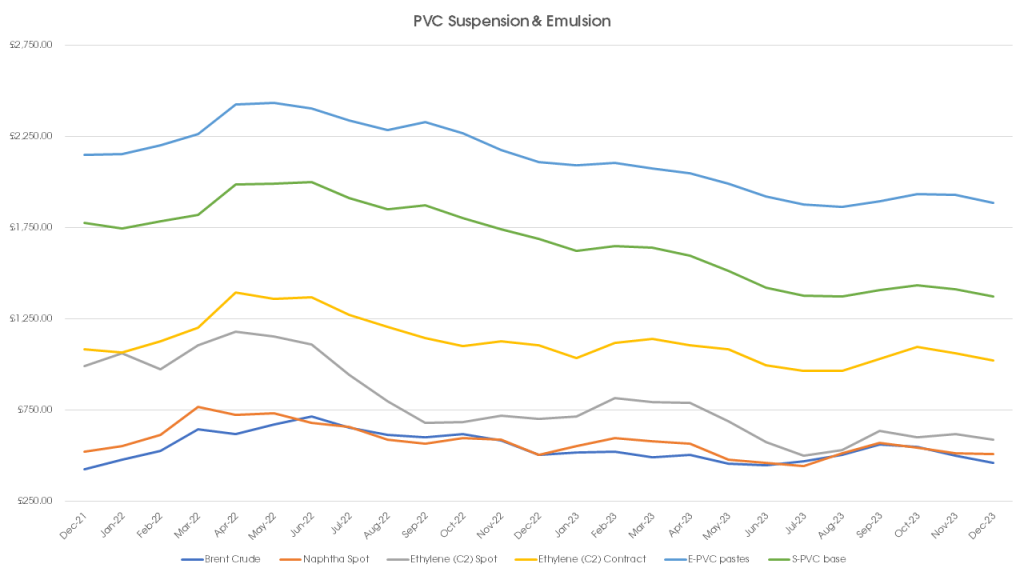

PVC – Suspension & Emulsion

Competition in the S-PVC sector was intense, with volumes from the USA offering the best value. The US is advantaged both in terms of C2, which is derived from the ethane contained in shale gas, and with low electricity costs which is important in terms of the energy intensive process needed to produce chlorine.

The economics of PVC production in Europe became so bad that producers are seeking support from the EU authorities and are considering pushing the case for anti-dumping duties.

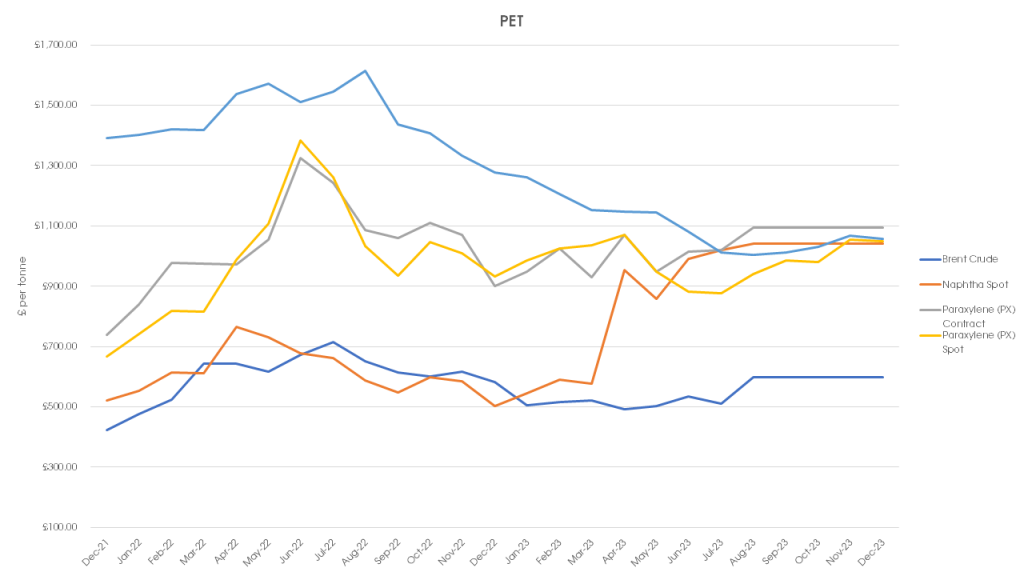

PET

The dynamics of the PET market are complex with the following factors all having the potential to significantly impact pricing:

- rPET pricing, the demand for which is rapidly increasing as a combination of pressure from consumers, retailers and brands escalates. These pressures are enhanced by the UK plastics packaging tax, and similar legislation that is being implemented in other countries.

- Use of PET in the textiles market, where PET is commonly substituted for natural cotton whenever this crop is scarce, and prices inflated.

- Seasonal demand for carbonated drinks, a market which is heavily influenced by weather conditions, with high temperatures typically increasing demand.

The supply of prime virgin PET was extremely competitive, with low price imports from Asia dominating the price action. Ineos announced the closure of significant capacity for PTA, a precursor to PET production.

As with S-PVC, European producers of PET have raised concerns about dumping in the European market, in this case citing India and China as sources of unfair trade.

Polyolefins

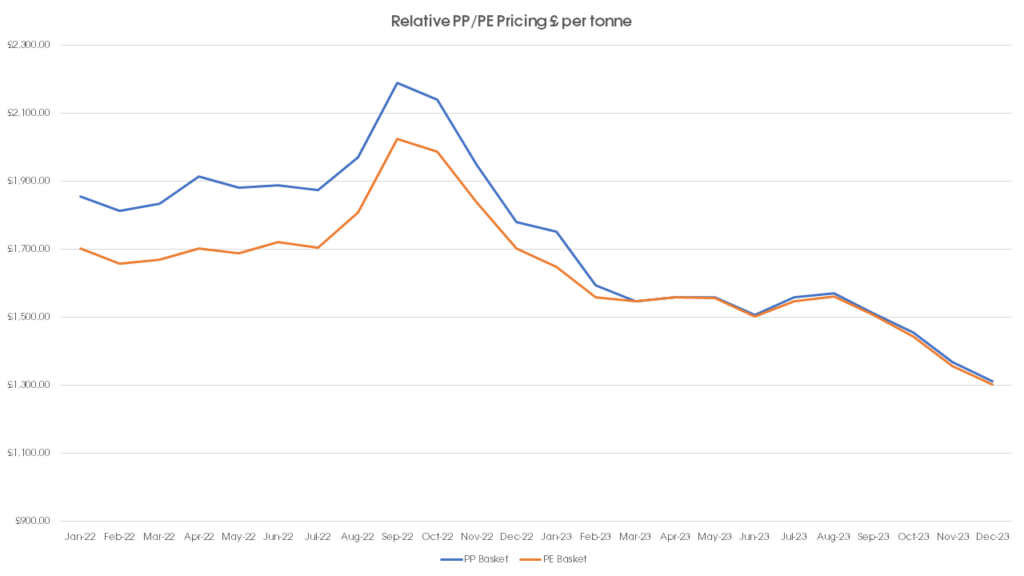

With the exception of a couple small upward blips in April and November, the price trend was fundamentally downward for the polyolefins basket. Polymer converters were able to exploit the strong competition amongst suppliers to their advantage.

Polypropylene and polyethylene pricing coincided by the end of Q1 2023, and this is due to a number of factors including:

- A relative reduction in the C3 price compared to the C2 price

- PP producers taking advantage of the low C3 spot pricing

- Lower production and/or demand for consumer durables such as cars and white goods for which PP is a much more significant market segment than it is for PE.

The supply of PE from the USA that resumed in 2022 became a dominant factor in 2023, with a strong flow of materials for film extrusion and blow moulding arriving at competitive prices. UK converters have become accustomed to the longer-lead times and consequent need to often make forward price commitments in order to secure supply.

2024 Outlook

UK Economic Outlook

The UK General Election, which is likely to be held in the second half of the year will be a significant factor affecting the UK economy, prior to which a budget in March may offer some economic stimulus through lower rates of taxation at either a personal or corporate level. Forecasts from the UK manufacturing sector are robust, with growth anticipated. Some recovery in the consumption of consumer durables is likely as consumer behaviour returns to a more normal pattern.

The UK Government continues to review the UK REACh legislation and has already extended the registration deadlines. Consultation that took place in 2023 may result in further changes and it is anticipated that registration fees are set to be lowered.

Logistics

The increase in shipping time resulting from not using the Red Sea and Suez Canal route is effectively reducing shipping and container capacity and this has caused a significant spike in spot container shipping rates. Whilst the effect on pricing is not likely to be as severe as it was in 2022, some polymer converters are facing shortfalls in supply at the start of 2024. If the situation in the Red Sea is resolved, then there will be a consequent reduction in shipping times, and with that the risk of a supply glut.

On the domestic front the issue with a shortage of HGV drivers appears to have eased, and even in the final quarter of 2023 when seasonal demand is high, there were no significant issues.

Logistics cost inflation appears to be easing due to a reduction in demand for physical storage as the inventory glut that resulted from the end of the Covid-19 era continues to diminish. The high cost of finance is also causing inventory levels to be reduced on the grounds of affordability.

Exchange Rates

US and UK elections are likely to have a significant influence on exchange rates. The outcome of the UK general election is more predictable, and any uncertainty will relate to the changes in economic policy that a new government may choose to make, or how manifesto pledges are delivered.

Crude Oil

The likely scenario is that Brent Crude will continue to trade in the 70 – 90 USD per barrel range, with energy companies trying hard to manage supply in an economic environment that will tend towards falling prices.

It is notable that many traditional energy companies that have been heavily reliant on Crude Oil sales, have increasingly diversified their sources of revenue, with many now turning more to renewables for sustainability both of the planet and for their business models.

Feedstocks

VCM (Vinyl Chloride Monomer)

Energy costs and price/demand for Caustic Soda will have a significant bearing on VCM economics, along with the price of C2. Increased US PVC capacity is likely to result in increased imports of S-PVC resin which will tend to cap monomer pricing.

PX (Paraxylene)

rPET pricing is expected to have a significant influence on PX costs, and the different economic structure of r-PET has the ability to cap prime virgin PET pricing and therefore also impact PX pricing. External factors such as demand for fibre applications, along with weather conditions will be of influence in terms of the supply demand balance.

C2 (Ethylene)

Ethylene pricing is likely to be heavily influenced by the level of PE imports from the USA, which are expected to increase further in 2024 and keep C2 pricing at relatively low levels.

C3 (Propylene)

C3 has a double reliance on crude oil refining in which C3 is a significant co-output of Naphtha cracking for ethylene and also a biproduct of the FCC (Fluidised Catalytic Cracking) process used to upgrade the petroleum fraction of crude oil distillate to the required environmental standards. Whilst the ratio of C2 to C3 in the Naphtha cracking process can be adjusted, this is within a relatively narrow window and therefore low C2 demand along with refinery output rates will impact C3 availability. Demand for petroleum is likely to be reduced through the increased use of EVs. Recovery in C3 demand to make polypropylene required for consumer durables, could tip supply/demand back in the favour of the producers. In turn this could lead to some cross-subsidy of C2, that is derived from Naphtha cracking.

Benzene

This is an important aromatic hydrocarbon compound which is the basis for the following intermediates including:

Ethylbenzene

Cumene

Cyclohexane

Nitrobenzene

Linear Alkylbenzene

Maleic Anhydride

Others

Of which Ethylbenzene, Cumene and Cyclohexane are precursors to key monomers including SM (Styrene based polymers), Bisphenol A (PC) and HMXDA (PA66)

Price volatility is expected to continue, particularly as petrochemical producers seek to improve the economics of this important aromatic petrochemical compound.

Copyright © 2023 Plastribution Ltd.